News

LIVE BLOG: 2023 Tesla Investor Day

There’s a lot of excitement around Tesla’s 2023 Investor Day, and for good reason. From Elon Musk’s Master Plan Part 3, details on the company’s third-generation platform, and discussions on how Tesla could each extreme scale, Investor Day promises to be an event that is one for the books.

Elon Musk has emphasized that Investor Day is really a lot bigger than the company’s shareholders. In past comments, the CEO noted that the “investors” Tesla is referring to in the event are pretty much all life on Earth. Yes, everyone, Tesla is thinking *that* big.

Following is a Live Blog of Tesla’s 2023 Investor Day. Please refresh this page regularly for the most recent updates.

18:59 CST – And that’s a wrap, everyone! This is Tesla’s longest event yet (I believe) and in typical Tesla fashion, it’s overflowing with information. There’s a lot to unpack from this event, so please so stay tuned for our coverage of the 2023 Investor Day’s specifics. Till the next time!

18:59 CST – A question about Tesla’s next-gen vehicle was asked. Any details that Tesla is willing to share? Elon declined to answer the question. He noted that Tesla would have a proper product event for the next-generation vehicle.

18:54 CST – A question about Tesla’s dry battery electrode efforts was asked. Drew Baglino noted that Giga Texas already makes dry electrode batteries. Every week, the program makes progress.

18:48 CST – Barclays asks to what extent the cost strategies outlined today differ by region. Tom Zhu noted that Tesla tries its best to be as localized as possible. The same is true for the labor force. This is especially notable in Shanghai.

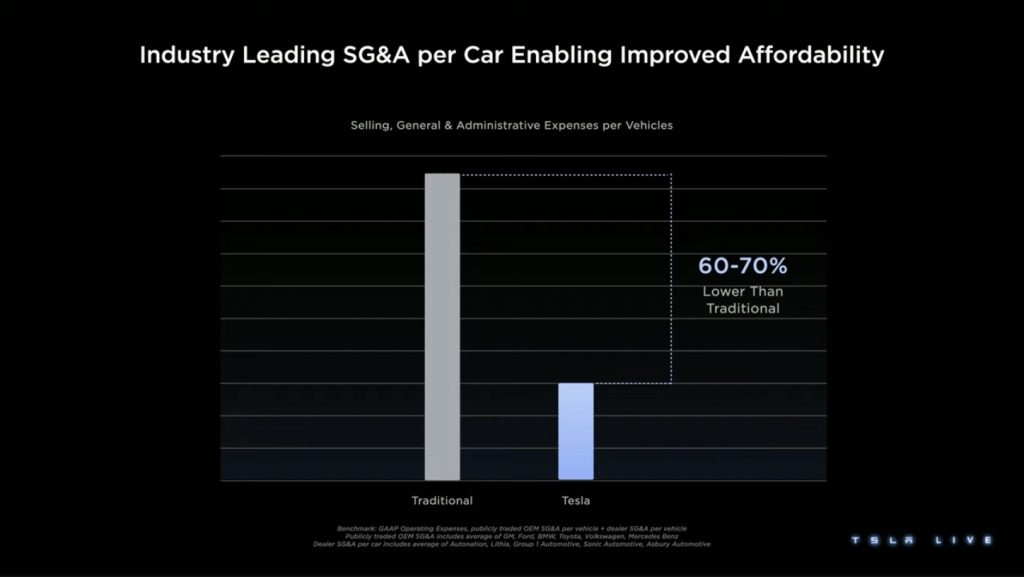

18:41 CST – Elon Musk noted that one thing that for the vast majority of people, things are affordability driven. He noted that sometimes, it’s easy to lose sight of how consumers acquire vehicles. It’s not that people don’t want a car. Most times, it’s a matter of whether people can afford one. “Affordability is what matters,” Musk said.

18:36 CST – A question was asked about Tesla and how China and the US’ tensions could affect the company. Ton Zhu noted that Tesla China has ample demand, sometimes more than the company can produce. Tom Zhu noted that he does not see much risk for Tesla overall

18:34 CST – Jefferies asks how many models Tesla plans to have to reach 20 million units. A question about bidirectional charging was also asked. Elon Musk noted that bidirectional charging is not that useful since Powerwall is better. Musk noted that Tesla does not plan too many models to reach 20 million cars. He estimates 10 models or so should be enough.

Musk noted that cars today just have variants for the sake of having variants. believes that cars will be like phones.

18:28 CST – Another question is asked about Tesla and its mining efforts. Elon noted that Tesla would address whatever is the limiting factor at any given point in time. Tesla would prefer not to get into mining, but the company will do so if needed. Drew Baglino referenced the company’s Corpus Christi lithium refinery. If Tesla could prove that things can be done faster, then the company’s suppliers could follow suit.

Elon mentions a cathode refining facility just down the road from Giga Texas as well. Drew Baglino noted that there’s no large-scale cathode refining facility in the US for now, so Tesla had to build one.

18:23 CST – Rod Lache from Wolfe Research asks about the timeline for Tesla’s plans. He notes that Investor Day doesn’t just seem like it’s for a vehicle. Elon noted that the most profound architectural changes would be in future vehicles. There will be changes for existing vehicles, of course. Lars Moravy noted that Tesla would be improving, especially in the next couple of years.

18:21 CST – The break ended up taking nine minutes. But the team is back, and Elon comes out and shows a render of Giga Mexico. Musk notes, however, that the capacity of Tesla’s existing factories will be ramped. Giga Mexico will be built in Monterrey.

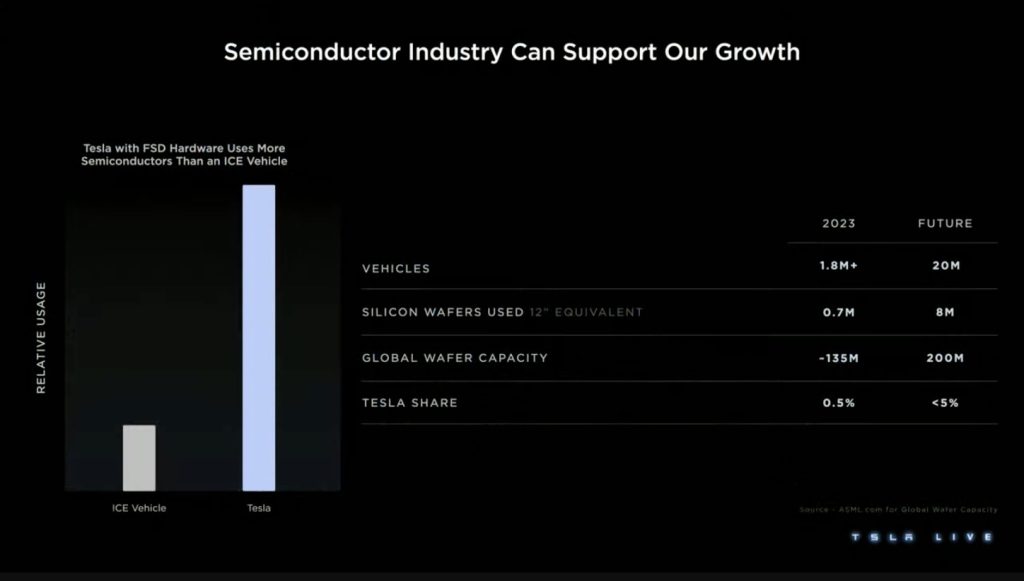

18:10 CST – Five-minute break! After this, a Q&A session.

18:04 CST – Kirkhorn discusses Tesla’s improvement in interior process efficiency. He noted that ultimately, Tesla’s vertically integrated software that helps run the company. Kirkhorn is also confident in Tesla’s ability to generate the income needed to make investments to achieve Master Plan Part 3’s goals.

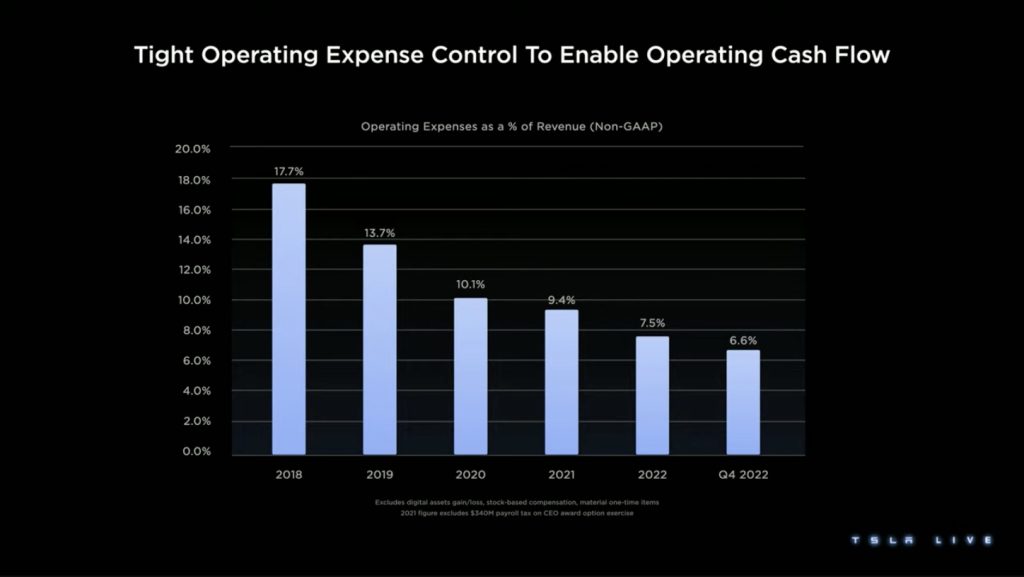

18:01 CST – Kirkhorn highlights Tesla’s Open and SG&A.

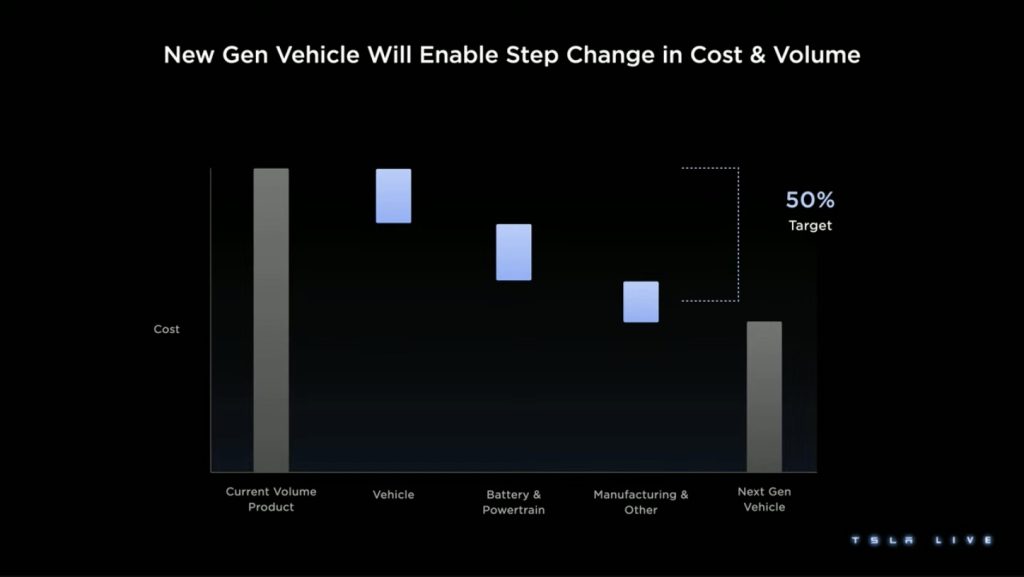

17:59 CST – Kirkhorn highlights that the next-gen platform is expected to enable a 50% reduction in costs. This means that the total cost of ownership of the next-generation platform would also be lower than the company’s current vehicles today. This is a big deal since the Model 3 is already cheaper to own than Toyota Corolla today.

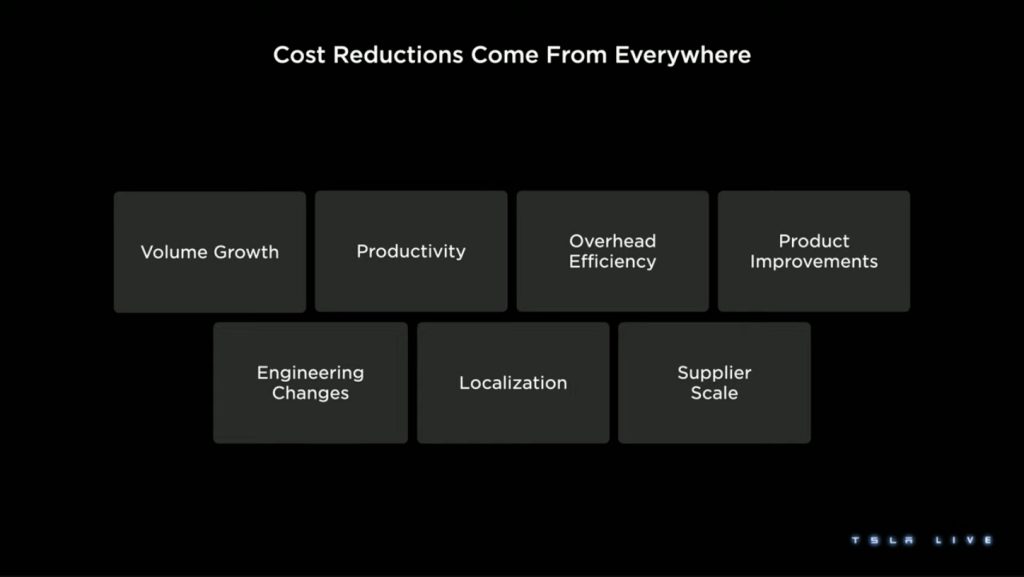

17:56 CST – Kirkhorn notes that cost reductions come from everywhere. He states that Tesla reduced the cost of the Model 3 by 30% since 2018 as of 2022.

17:54 CST – Zach Kirkhorn returns to the stage. This will be the final part of the Investor Day presentation. He notes that this is the first time that Tesla brought out its specific leaders to discuss their work. He thanks the Tesla team as well.

17:51 CST – Laurie Shelby takes the stage to talk about the sustainability for Tesla for employees. Tesla seems to be taking a pretty cautious strategy here. The company wants to emphasize how the company values its team. She thanks the global Tesla team. She also noted that Tesla is aligning with the TSFD to release better reports to investors.

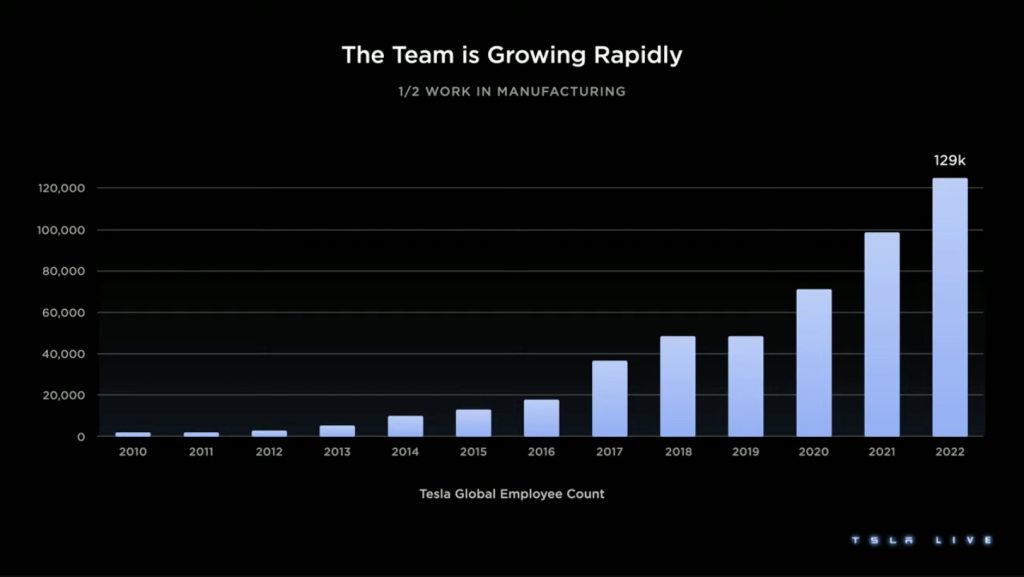

She notes that Tesla now has 129k employees. Almost 60% are based in the US.

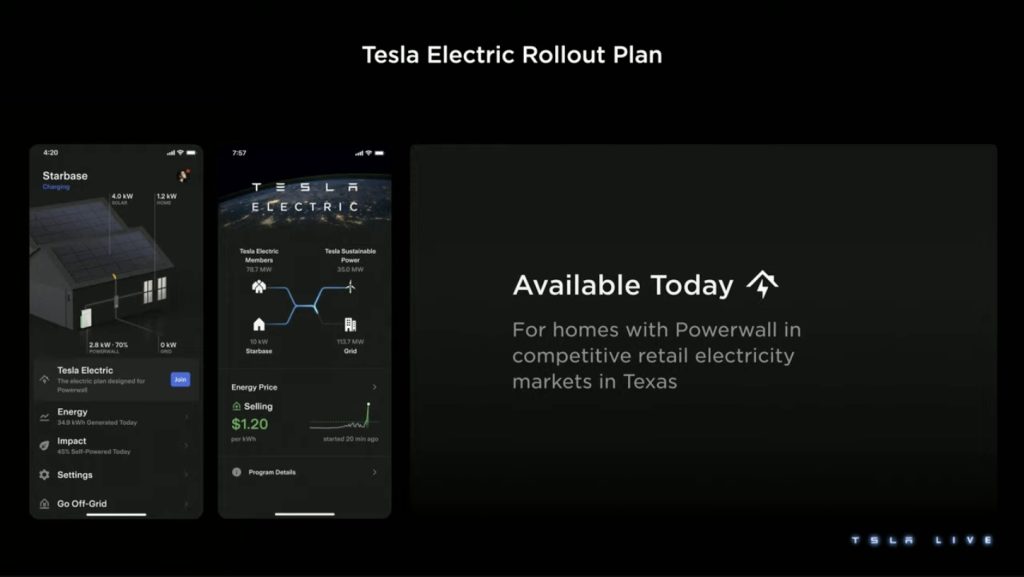

17:47 CST – Tesla Electric is rolling out in Texas too! The company plans to bring Tesla Electric market by market like Tesla Insurance. The service’s rollout in Texas will include $30 charging at night for customers who sign up for Tesla Electric.

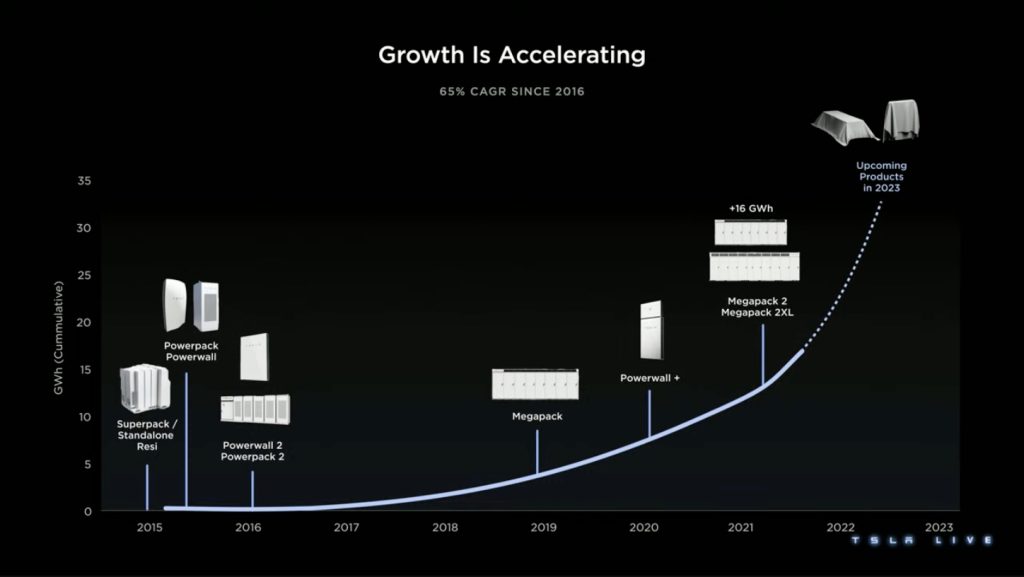

17:45 CST – The Megafactory in Lathrop may not be as high profile as the company’s Gigafactories, but it was built in less than a year. That’s pretty incredible. Project installations are also getting faster, with the company achieving 4X installation and commissioning speed since 2019.

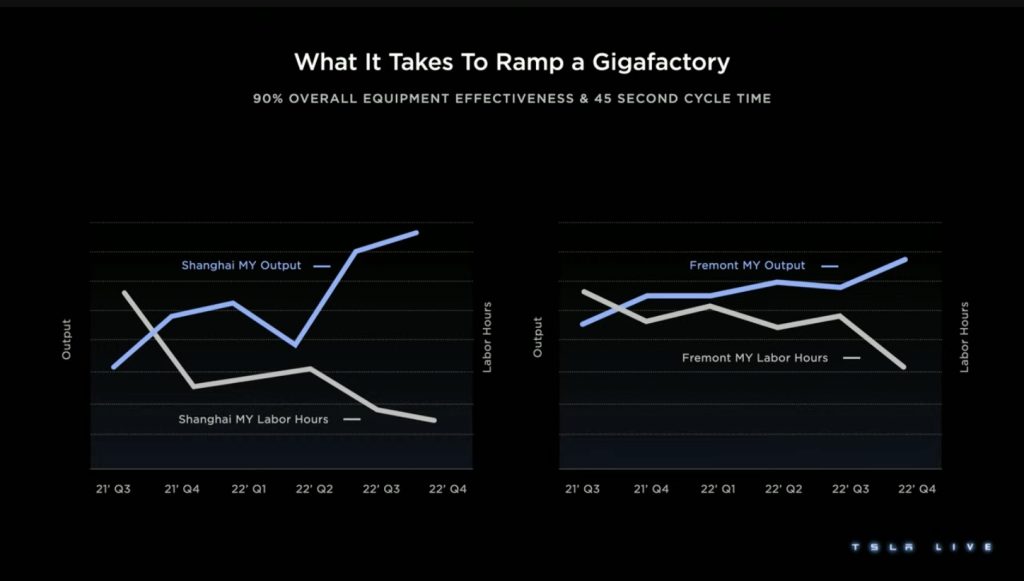

17:37 CST – Mike Snyder joins Drew Baglino the stage to talk Tesla’s Megapack. He noted that Tesla is now on its sixth generation of energy products, the Megapack XL and the Megapack 2. There’s been a lot of demand for the Megapack, and the Lathrop plant is ramping. This was only made possible by a maniacal focus and effort.

“This is the product that retires fossil fuels. One power plant at a time,” Baglino said.

17:33 CST – A photo of Tesla’s 50 GWh/year Corpus Christi Lithium Refinery was shared. The facility starts commissioning at the end of 2023.

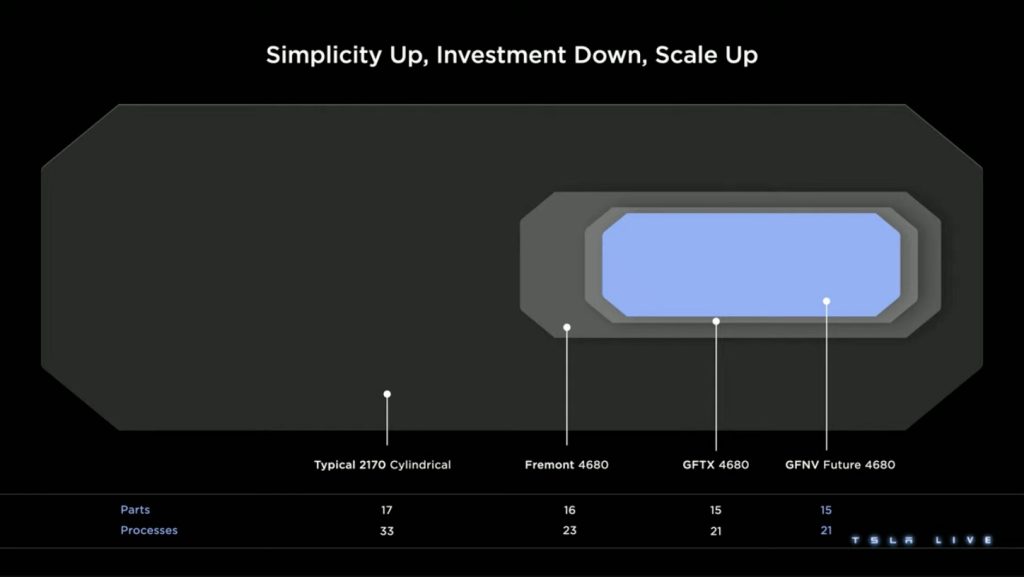

17:32 CST – Drew Baglino provides a quick update on Tesla’s battery program. No more spoons! There’s over 20x productivity from the tools the company showed during Battery Day at the pilot line in Kato Road. He also showed how Tesla’s battery factories are getting more and more efficient and simple, so they’re only getting better.

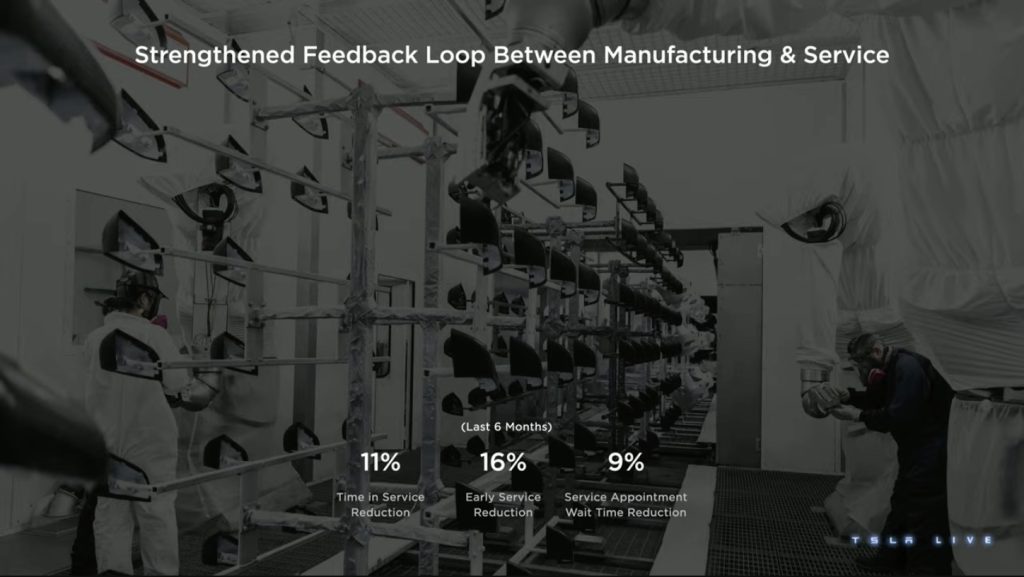

17:29 CST – Tom shares some states on Tesla service.

17:27 CST – Tom notes that ramping a Gigafactory is all about overall equipment effectiveness and cycle time. Fremont is a rockstar here, since it’s an older factory. But despite this, it’s getting better. Tom notes that Fremont just reached a new daily record recently.

17:26 CST – Tom notes that ramping a Gigafactory is all about overall equipment effectiveness and cycle time.

17:25 CST – Tom highlights that Tesla can build its factories extremely quickly. He noted that this is accomplished through many optimizations, such as an in-house team that constructs factories. He noted that the team behind Giga Shanghai was also the same one that did Giga Berlin.

Tom Zhu also confirms that Tesla has reached the 4 million vehicle mark. The vehicle was made in Giga Texas. The last 1 million cars were made in less than 7 months.

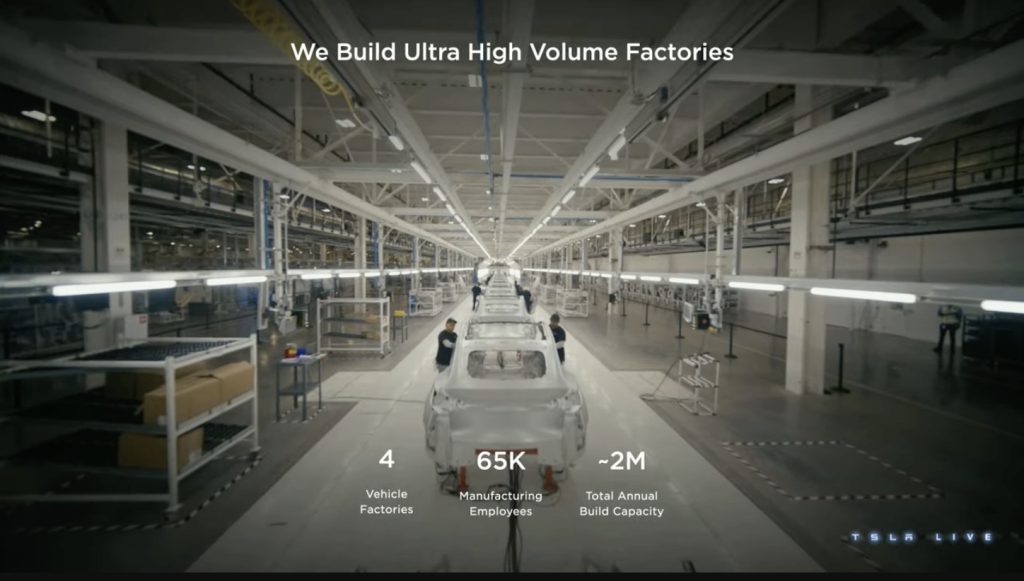

17:22 CST – Tom Zhu and Drew Baglino take the stage. They will be discussing how Tesla would make more cars, and how much faster the company could do it. Tom notes that Tesla currently have 65,000 manufacturing employees. Tesla’s factories are also ultra high-volume.

17:19 CST – The Tesla execs noted that the company’s Heat Pump assembly highlighted supply chain issues. Tesla solved heat pump assembly issues through automation.

17:16 CST – The Tesla execs noted that Tesla will not break the semiconductor industry if it grows to 20 million vehicles. The semiconductor industry can support the electric vehicle maker’s growth, even if Tesla slows down — which would likely not happen.

17:14 CST – Tesla is also working with suppliers closer to their factories to decrease transportation time and reduce diesel use throughout the supply chain. This also decreases full productions stall times.

17:10 CST – The Tesla executives discuss the challenges that the company and its suppliers faced during the Covid pandemic. The ordeal was tough, though the company and its suppliers powered through to deliver.

17:04 CST – Tesla executives Karn Budhiraj and a colleague discuss the company’s supply chain. They provide an overview of Tesla’s current supplier setup.

17:01 CST – Overall, while Tesla has already been building Superchargers for the last ten years, the company is still just starting. Tesla Supercharger V4 is being installed in Europe, and it will be optmized for charging all electric cars, not just Teslas. Amidst all this, Tesla will never forget to do some cool things in the process.

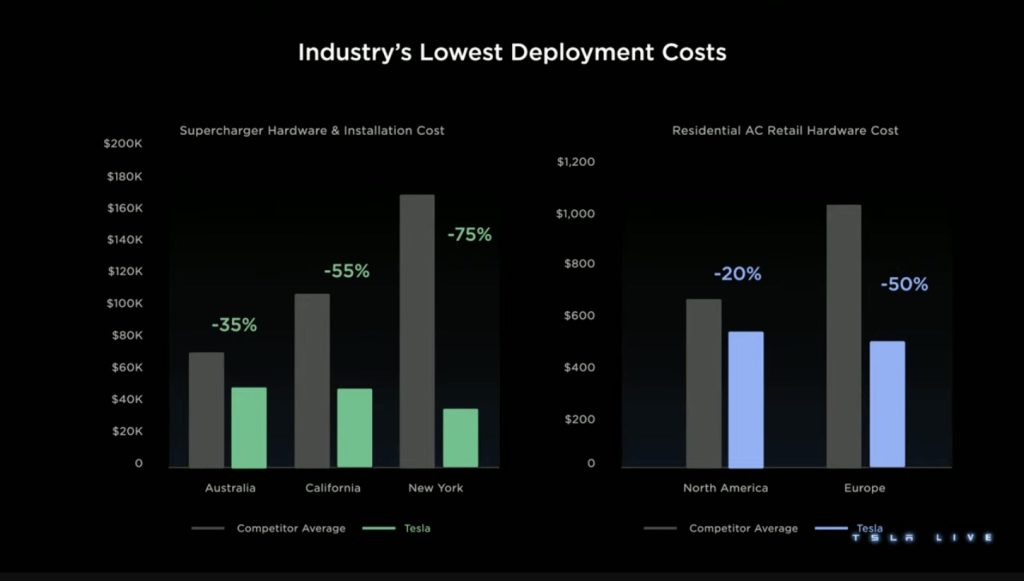

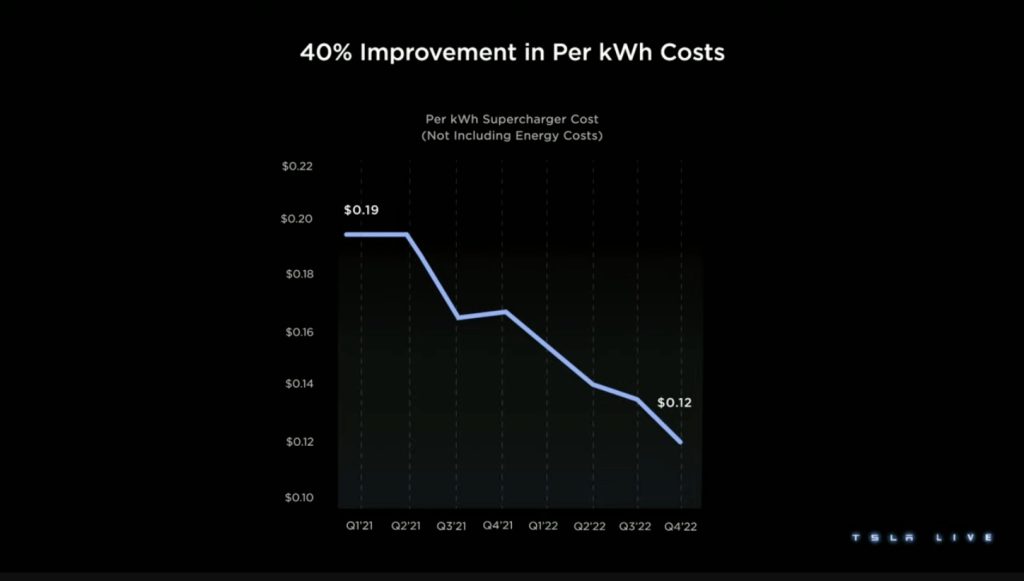

16:54 CST – Rebecca Tinucci takes the stage to discuss Tesla’s Superchargers. She highlighted that Tesla has spent the last ten years establishing its Supercharger Network across the world. Thanks to this experience, Tesla Superchargers have the lowest deployment costs. She notes that prefabricated four-post Superchargers are being produced at Giga New York. She also hinted that Tesla plans to improve Trip Planner by projecting potential customers that might use nearby charging stations.

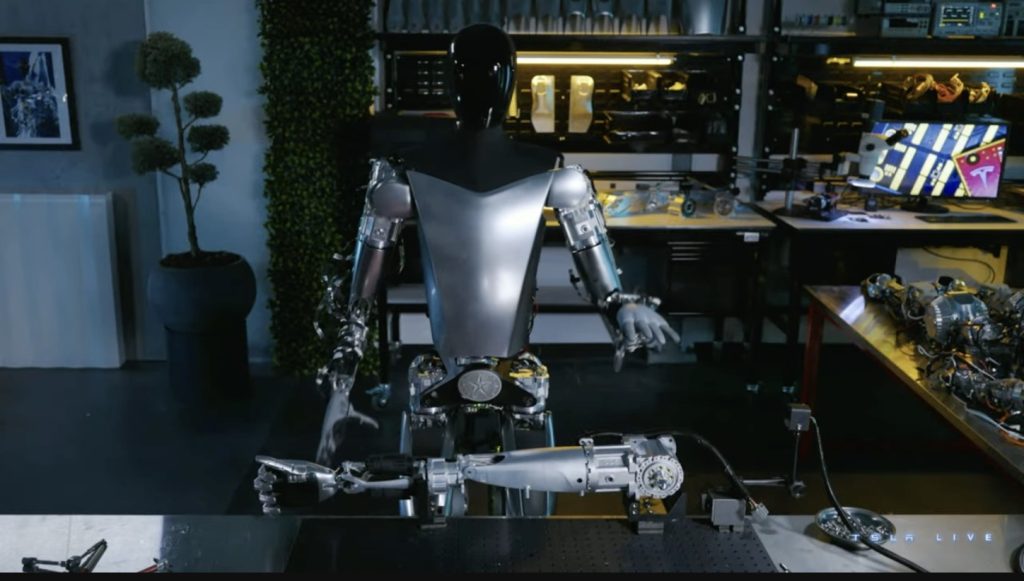

16:51 CST – Elon notes that Optimus utilizes Tesla’s expertise in manufacturing. Actuators, battery packs, and Optimus’ other key components are custom designed by Tesla. Elon also noted that Tesla was shocked that not a lot of parts to make a humanoid robot can be bought “off the shelf.” The CEO is also confident that Tesla can bring a working, useful humanoid robot to scale faster.

16:48 CST – Elon returns to the stage for some more updates. A video of Optimus is shown. The humanoid robot seems more refined compared to its iteration during AI Day 2022. The robot is now walking, and working on another robot. Multiple Optimus prototypes are also working.

16:42 CST – Ashok highlights that Tesla’s approach to AI systems is quite different from before. This allows the company to solve complex planning problems using artificial intelligence, among others. He also noted that manual labeling is insufficient, so Tesla is adopting an automated labeling system. Also, Dojo will perform better than current “compute” capabilities at Tesla.

16:38 CST – Ashok Elluswamy takes the stage to discuss Full Self-Driving. he notes that self-driving is actually a critical part of a sustainable future. He noted reiterated Elon Musk’s points in Master Plan Part 2, where unused cars could be used by other commuters.

16:34 CST – Pete Bannon and David Lau noted that during the days of the Model S, it did not take long before it because evident that it was easy to misassemble the car. These were adjusted in later vehicles. Today, mistakes in assembly are caught while the vehicle is being produced.

16:32 CST – Pete Bannon and David Lau discussed how Tesla’s software and connected cars enable the company to roll out improvements at speed. This is especially useful for vehicles’ safety, which Tesla excels in. The Model S and Model X’s predictive air suspension system is a good example of this.

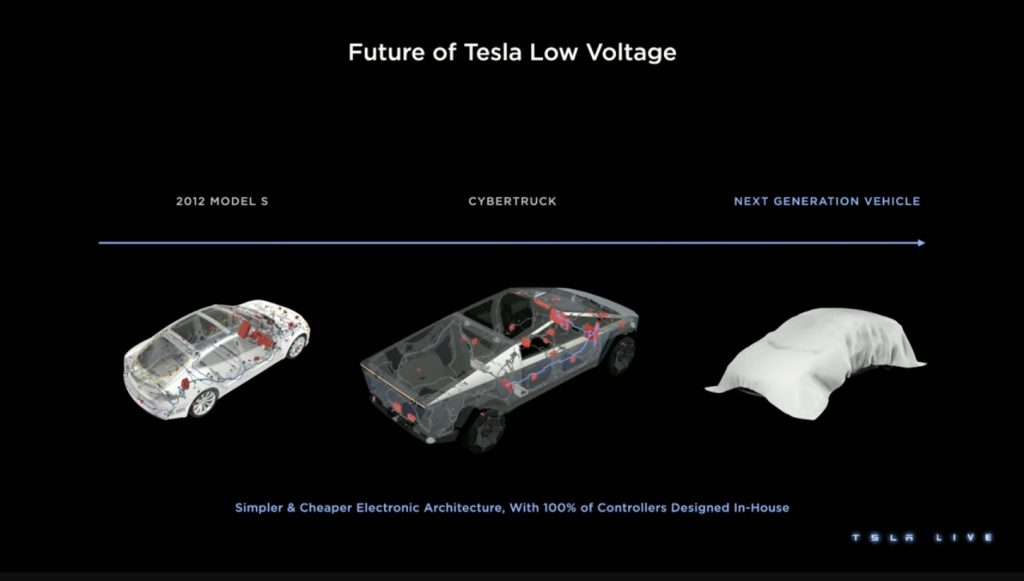

16:26 CST – Pete Bannon and David Lau show the path toward the next-generation platform.

16:23 CST – Pete Bannon and David Lau discuss more optimizations that have been done over the years. These include the shift e-fuses, as well as the replacement of lead acid batteries to lithium-ion. Costs are coming down too, such as in components like the Model 3’s center display, which has gotten cheaper over time.

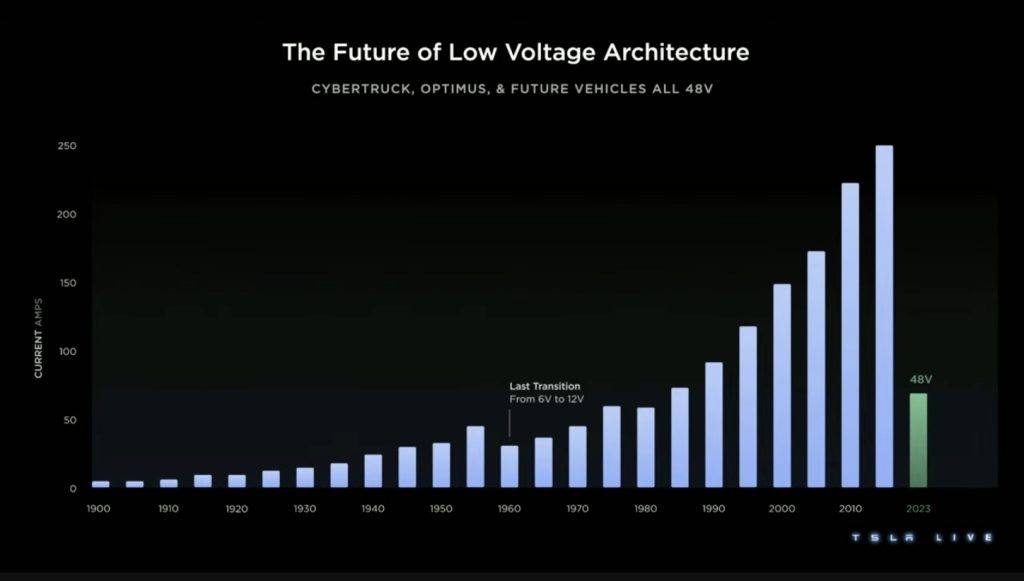

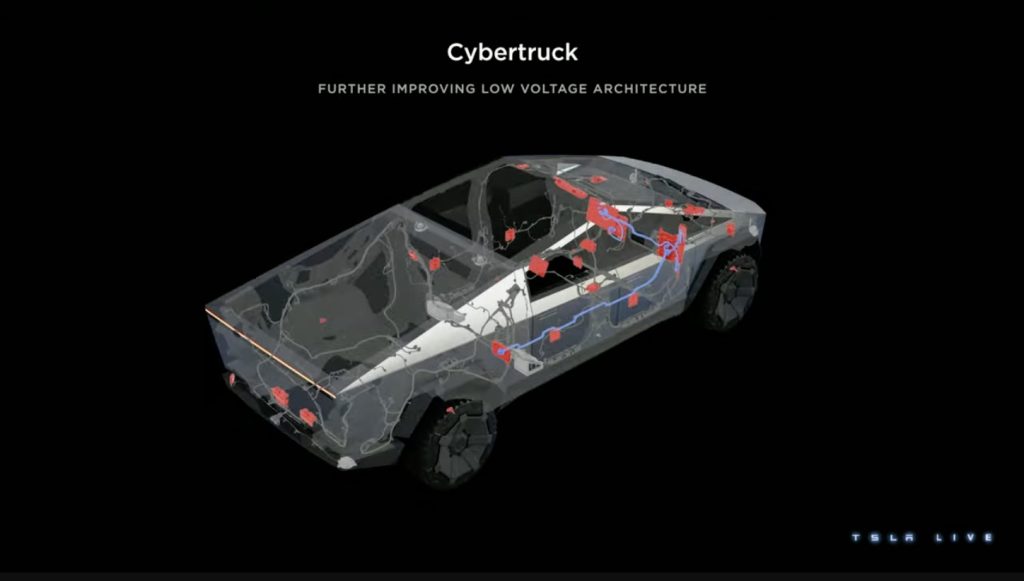

Cybertruck, Optimus, and future vehicles will also use 48-volt architecture. Cybertruck is also designed with a local controller for better wire pathways.

16:23 CST – Pete Bannon and David Lau discuss more optimizations that have been done over the years. These include the shift e-fuses, as well as the replacement of lead acid batteries to lithium-ion. Costs are coming down too, such as in components like the Model 3’s center display, which has gotten cheaper over time.

16:20 CST – Pete Bannon and David Lau take the stage. Pete Bannon highlighted that low-voltage electronics in vehicles have been messy so far. The executives noted that from Model S to Model 3, Tesla was able to reduce its wire harnesses by 17 kilograms. Shared controllers also helped simplify the supply chain.

For Cybertruck, Tesla is designing 85% of the controllers in the car. In the next-gen platform, Tesla is designing 100% of the controllers.

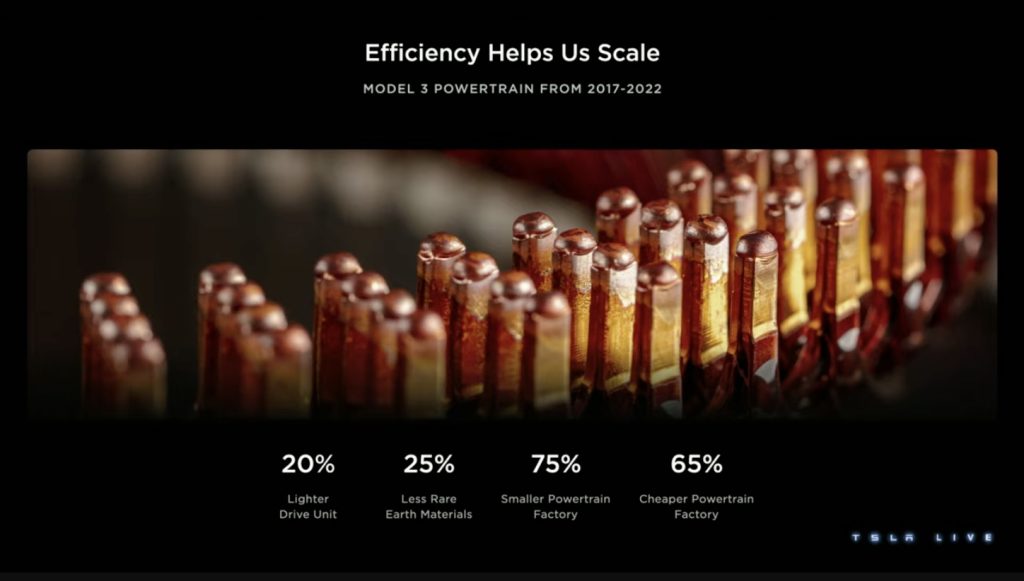

16:17 CST – Colin noted that Tesla’s next-gen vehicle will not use rare earth materials at all. They will be built in compact and high-efficiency factories. The executive stated that these are only possible because of the hard work of the Tesla team.

16:15 CST – Colin also discusses the importance of Tesla’s power electronics and software. He also highlighted that Tesla excels in manufacturing line and automation design. This enables Tesla to design products that are both high-performance and easy to assemble.

Tesla’s next-generation platform will have 75% less silicon carbide. Any battery chemistry will be accepted as well. The vehicle will feature a 50% reduction in factory footprint.

16:11 CST – Colin Campbell, leader of powertrain engineering, takes the stage. He noted that Tesla is known for speed. He highlighted that Tesla is all about efficiency. He noted that Tesla is able to achieve its efficiencies by moving as one company. Changes can then be made to both vehicles and factories. Everyone works together.

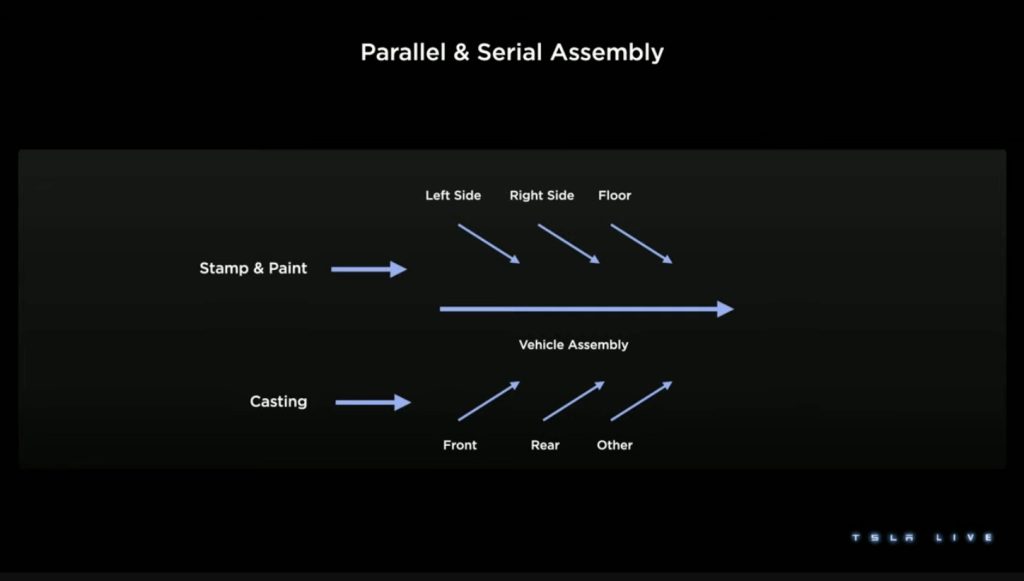

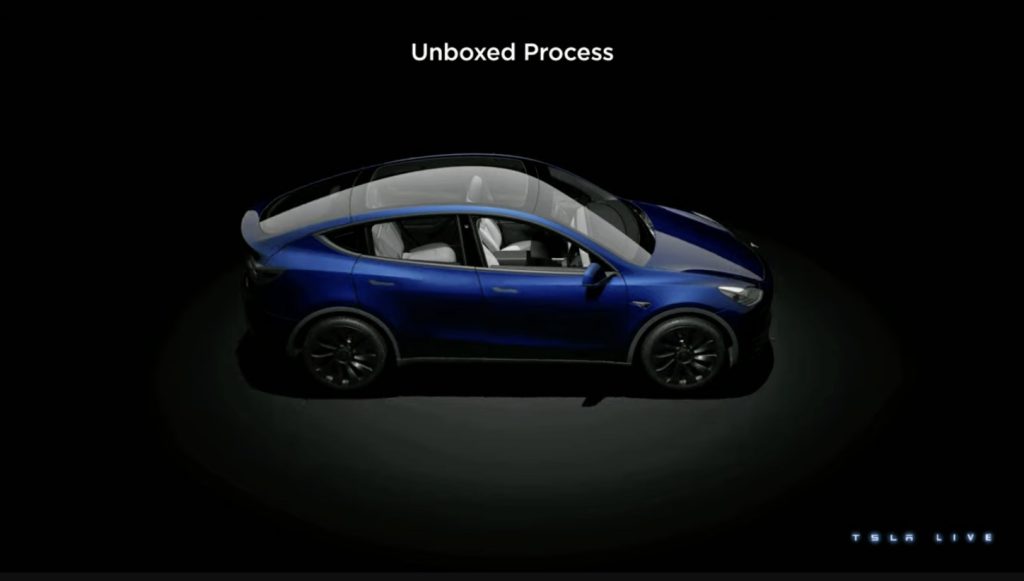

16:07 CST – Franz and Lars noted that in the next-generation vehicle, more people (or robots) should be able to work simultaneously. Lars noted that this gives more operational density. More space time efficiency. This makes automation a lot easier. Tesla lists this as an “unboxed process.”

Franz and Lars noted that Tesla’s next-gen manufacturing would reduce 50% of costs.

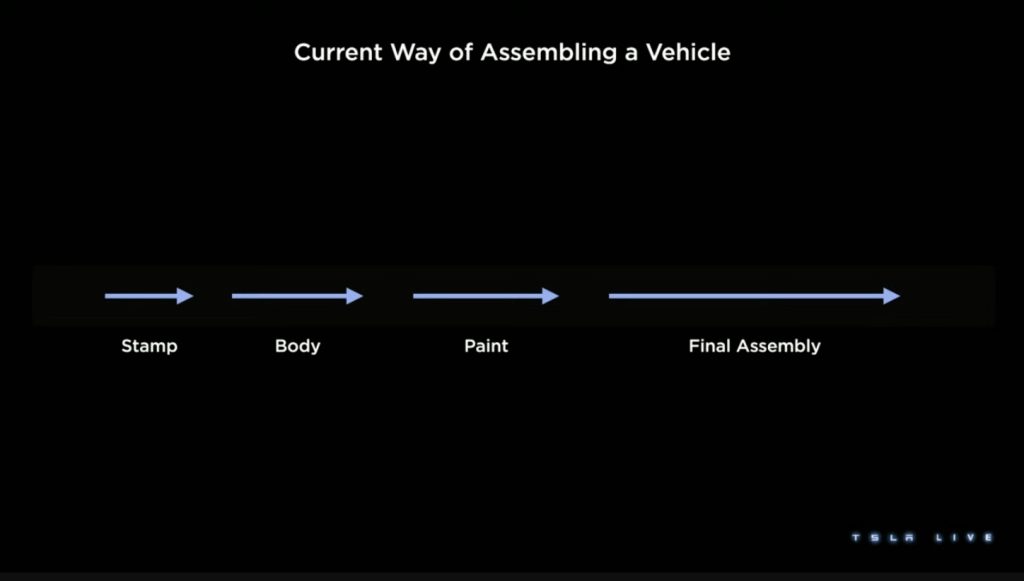

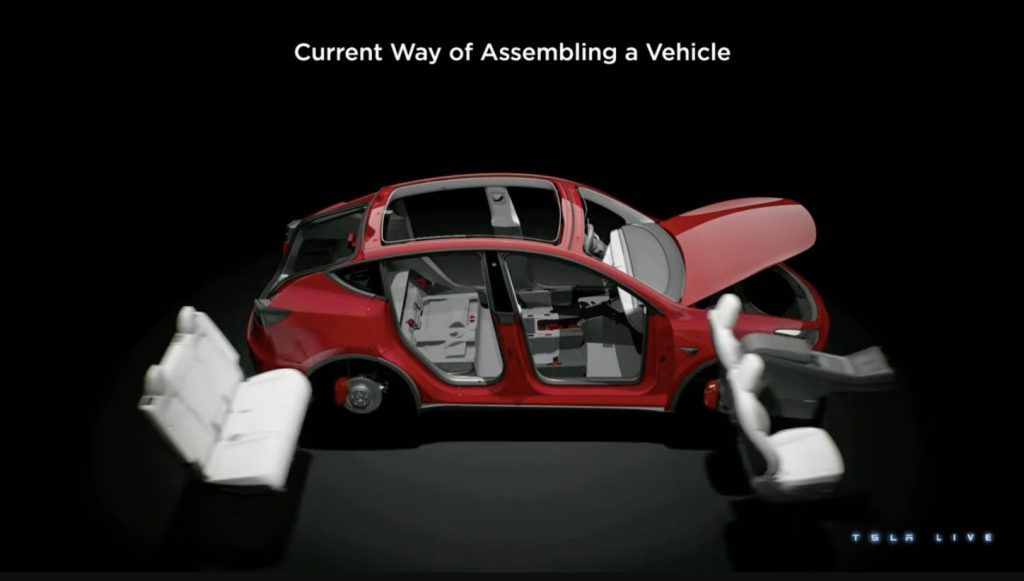

16:04 CST – Franz and Lars discuss the traditional way to assemble a vehicle, from stamping, body, paint, and final assembly. Lars note that this is great, but delays in one line stops the entire thing. He stated that there are a lot of inefficiencies in the process. Lots of areas for improvement.

16:02 CST – Franz and Lars noted that Cybertruck is a completely different animal. It is then a vehicle that needs to be approached in a completely different manner. Cybertruck was designed with the manufacturing process in mind. Lars added that the Cybertruck actually makes its manufacturing footprint small, since it doesn’t need paint or stamping. Franz reconfirms Cybertruck is coming this year.

16:00 CST – Franz and Lars noted that as time went on, Tesla had to approach its vehicles more differently. This was the case with the Model 3. The executives discussed production hell, which involved Tesla looking to manufacture a product designed to be built manually being built on an automated line. There were lots of lessons learned there.

15:58 CST – Franz notes that during Tesla’s early days, it was a lot different. There were only a handful of people then, but Tesla was already dead set on making a difference. Franz noted that Tesla’s small teams before allowed the company to really focus on the nitty-gritty details of the car. The Model S is one of these, Franz and Lars said.

15:56 CST – Franz von Holzhausen and Lars Moravy take the stage for Part 2.

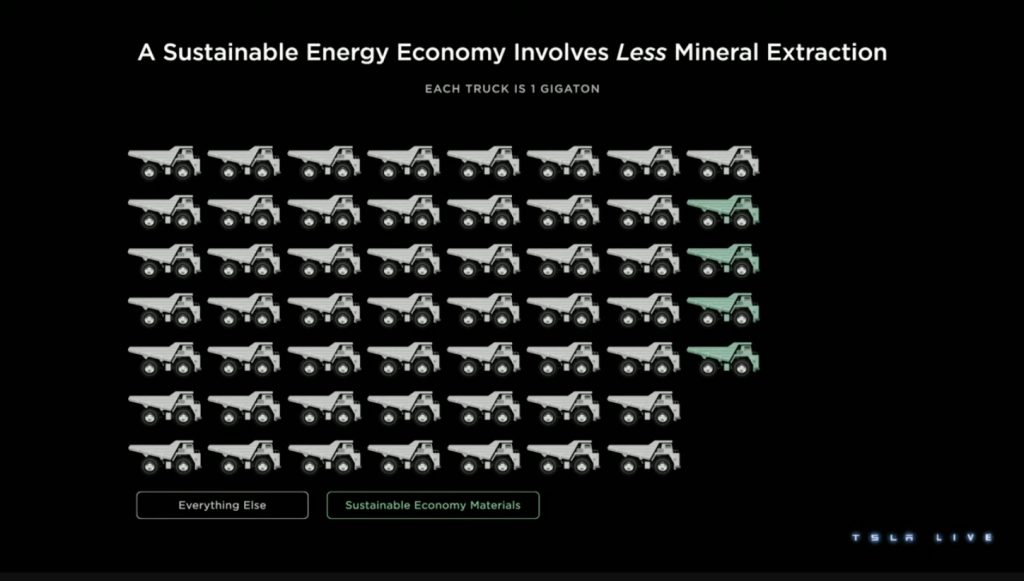

15:55 CST – Drew Baglino addresses the question of mineral use as the Earth shifts to a sustainable energy economy. Elon also reiterated his previous statements about lithium.He notes that the lithium in the United States is already very abundant. It’s the refining of lithium that’s a limiting factor today.

Elon also noted that nickel is needed for aircraft, boats, and long-range cars. The vast majority of transportation will need iron. And with recycling in the picture, the resources that the world will need to shift to sustainability will be even more efficient.

15:53 CST – The Tesla executives highlighting that transitioning to a sustainable economy will actually involve less fossil fuels compared to what’s currently being spent today. Here’s a nifty little graphic.

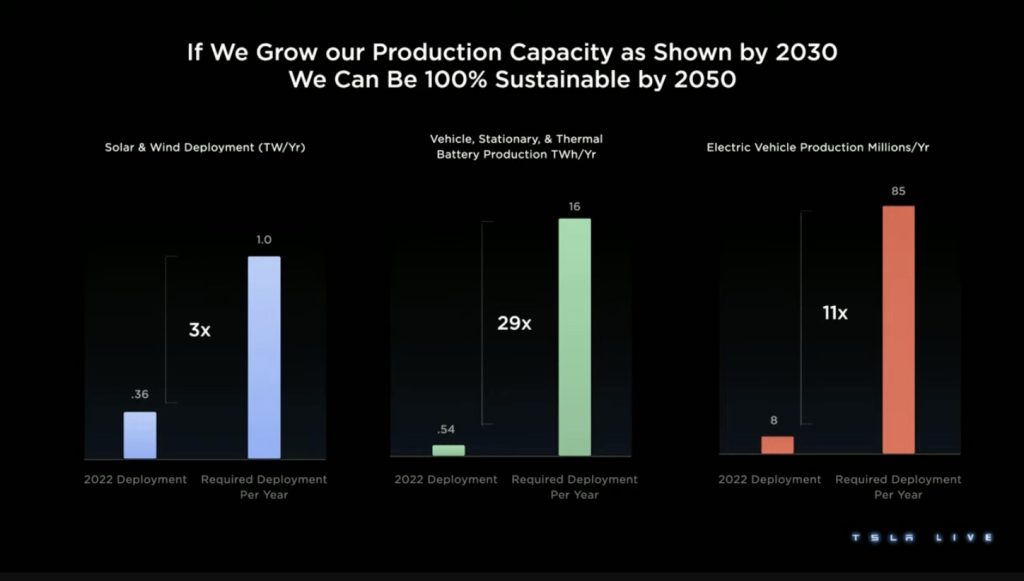

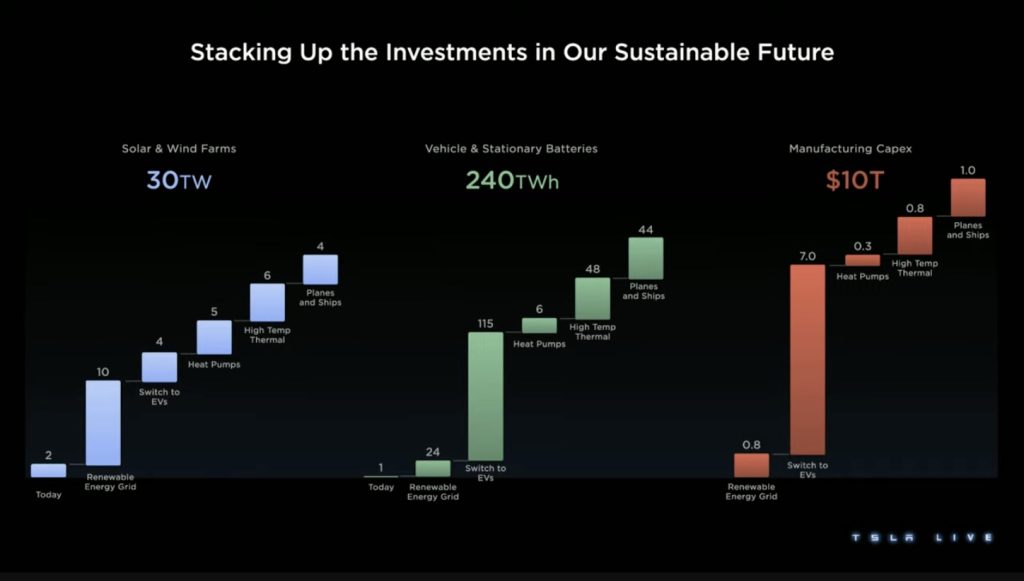

15:49 CST – Elon and Drew noted that these estimates for the investments needed to propel the world to sustainability are completely feasible.

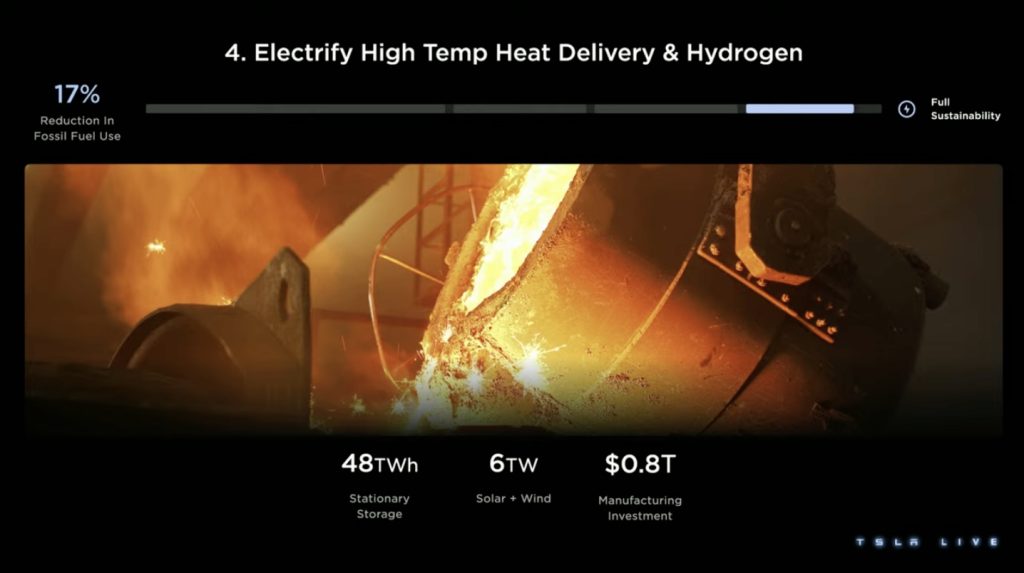

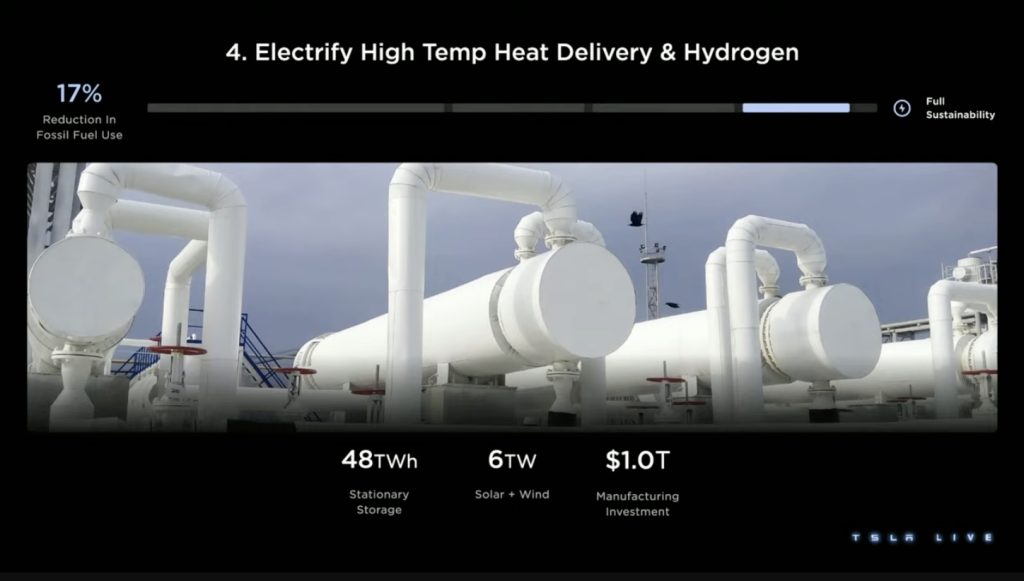

15:46 CST – Drew Baglino noted that heat pumps would go a long way toward making homes sustainable. From an industry perspective, heat pumps pave the way for efficiencies. He also discusses high temp heat delivery and hydrogen. Elon notes that hydrogen will be useful for industrial processes, but it is NOT something that should be used for cars. He also sheds light on the need to shift the shipping industry to sustainability.

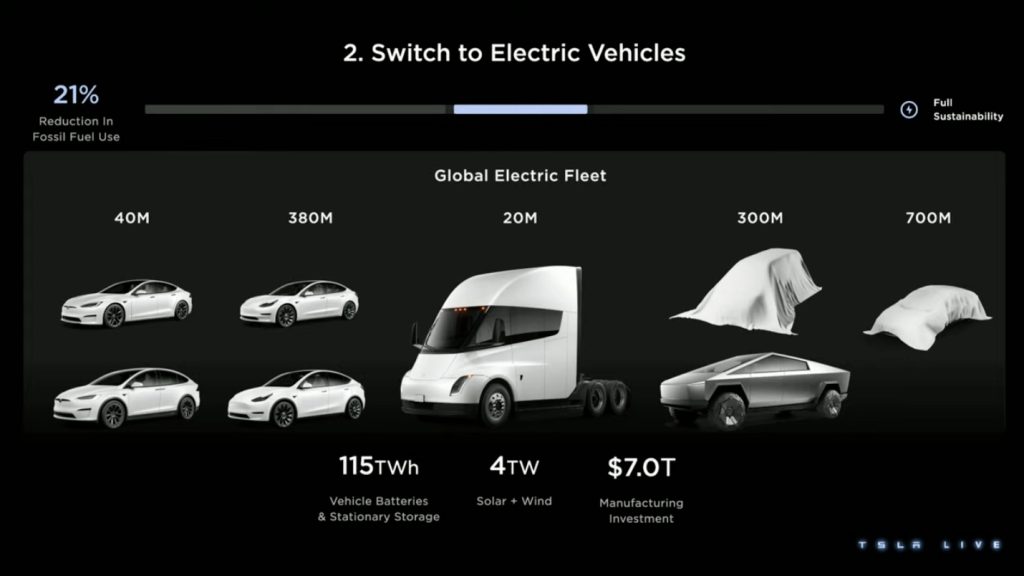

15:43 CST – Tesla gives a quick overview of how Tesla could create a global electric vehicle fleet. The company shows an assumption for a fleet of about 85 million vehicles. That’s already substantial.

15:40 CST – Elon notes that all forms of transport will probably be electric. But not rockets, at least for now.

15:38 CST – Elon and Drew show a slide showing what’s needed to reach a sustainable economy. The executives noted that while these numbers may seem large, they actually are not if they’re compared to the global economy. Just about $10 Trillion investment to build sustainable energy economy.

“For a remarkably small land area, we can go fully sustainable,” Musk said. “The electrified economy will use less resources than the (fossil fuel) economy.”

15:33 CST – Drew Baglino notes that today’s energy economy is dirty and wasteful, and that 80% of global energy comes from fossil fuels. Musk highlights that the use of fossil fuels actually waste a lot of energy. He also noted that calculations for a sustainable world typically assumes the same wastage as a world powered by fossil fuels. This, Elon Musk noted, is not accurate.

15:31 CST – Elon Musk notes that there is a path towards sustainability, where the Earth could support the 8 billion people today. “There is a clear path to a sustainable energy Earth with abundance,” Musk said.

15:30 CST – Elon Musk and Drew Baglino take the stage for the event’s first part. Elon jumps right into it. This is Master Plan Part 3. Here we go.

15:28 CST – And it’s starting! CFO Zach Kirkhorn is opening the event. Kirkhorn noted that today, Tesla is not just talking about the near future.

There will be three parts of the event. One, Tesla’s macro vision. Next, it will be focused on Tesla’s function. The third will bring everything back.

15:25 CST – Well, it seems like the stage is ready for the Investor Day keynote.

15:23 CST – Elon said the presentation starts in about 5 minutes — 8 minutes ago.

15:20 CST – Never change, Tesla. And never change, Elon.

15:19 CST – Check out these Model Y castings outside Giga Texas. Definitely highlighting this “extreme scale” theme Elon Musk referenced.

15:17 CST – What are you most excited for in Tesla’s 2023 Investor Day? Master Plan Part 3? More Cybertruck deets? The third-gen platform? Please sound off on our comments section below! I’m personally biased for the third-genp platform, but only because I’m a cheap guy by default.

15:14 CST – Well, Tesla is late, and the EV community has a great sense of humor. Who’s playing the 2023 Investor Day Bingo? I have a feeling the “wears trademark jacket” and “cracks joke” are getting crossed out really fast.

15:13 CST – I just noticed that the light show graphics that Tesla has been showing in its livestream are shaped like body panels. Look at that, it’s the rear seats of the Model Y. It is a Model Y, right?

15:10 CST – The stream for Investor Day has not really started yet, but there are already some nice updates from attendees of the event. Take the Cybertruck production beta, for example. That beast looks pretty good. I’m not sure how to feel about the five-seat layout, though. I kinda miss the six seats in the original prototype.

15:07 CST – A close-up of that Investor Day graphic shows that the EV bodies may be Model Y crossovers, at least based on the shape at the rear. The event is now a few minutes late, which, in Tesla terms, is still pretty early.

15:05 CST – By the way, if you’re just joining us, welcome! Here’s a livestream of the event too.

15:02 CST – Tesla’s intro video for Investor features the graphic in the event’s invite. They were not kidding about this “scale” thing. It reminds me almost of “The Matrix.”

15:00 CST – Tesla’s livestream link for Investor Day is live! Here we go!

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

News

Stellantis unveils solid-state battery for EVs

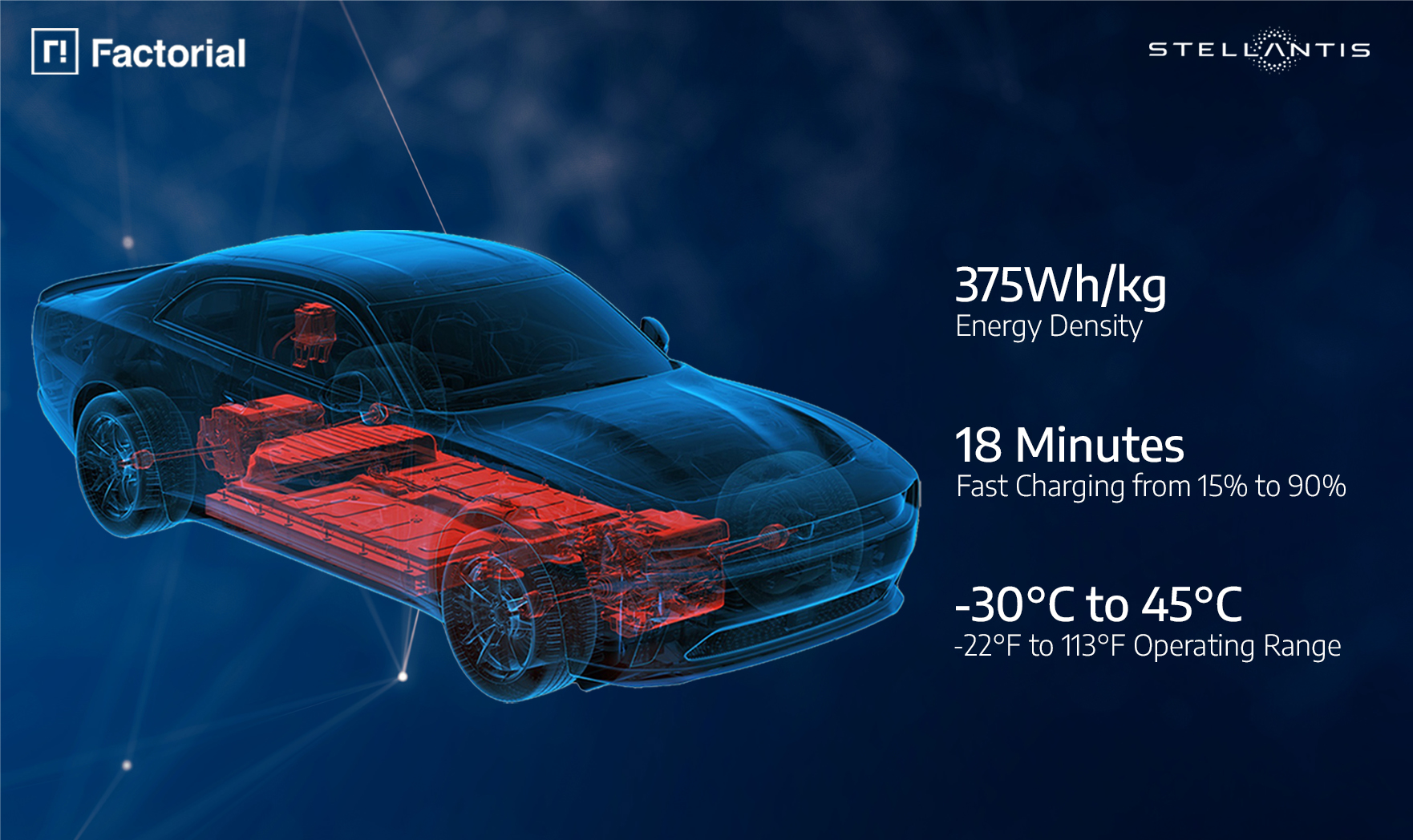

Stellantis validated solid state battery cells for EVs: ultra-dense, fast-charging, and AI-optimized. Launching demo fleet by 2026.

Stellantis N.V. and Factorial Energy have validated Factorial’s automotive-sized FEST® solid-state battery cells, a major milestone for next-generation electric vehicle (EV) batteries. The breakthrough positions Stellantis and Factorial to advance EV performance with lighter, more efficient batteries.

“Reaching this level of performance reflects the strengths of our collaboration with Factorial.

“This breakthrough puts us at the forefront of the solid-state revolution, but we are not stopping there. We continue working together to push the boundaries and deliver even more advanced solutions, bringing us closer to lighter, more efficient batteries that reduce costs for our customers,” said Ned Curic, Stellanti’s Chief Engineering and Technology Officer.

The 77Ah FEST® cells achieved an energy density of 375Wh/kg, supporting over 600 cycles toward automotive qualification. Unlike lithium-ion batteries, these solid-state cells charge from 15% to over 90% in 18 minutes at room temperature and deliver high power with discharge rates up to 4C. Factorial’s AI-driven electrolyte formulation enables performance in temperatures from -30°C to 45°C (-22°F to 113°F), overcoming previous solid-state limitations.

“Battery development is about compromise. While optimizing one feature is simple, balancing high energy density, cycle life, fast charging, and safety in an automotive-sized battery with OEM validation is a breakthrough,” said Siyu Huang, CEO of Factorial Energy. “This achievement with Stellantis is bringing next-generation battery technology from research to reality.”

The collaboration optimizes battery pack design for reduced weight and improved efficiency, enhancing vehicle range and affordability. Stellantis invested $75 million in Factorial in 2021 and plans to integrate these batteries into a demonstration fleet by 2026. This fleet will validate the technology’s real-world performance, a critical step toward commercialization.

The milestone aligns with Stellantis’ push for sustainable EV solutions, leveraging Factorial’s disruptive technology to meet the rising demand for high-performance batteries. As the companies refine pack architecture, the validated cells promise faster charging and greater efficiency, potentially reshaping the EV market. With the demonstration fleet on the horizon, Stellantis and Factorial are poised to lead the solid-state battery push, delivering cost-effective, high-range EVs to consumers.

News

Tesla China vehicle registrations rise 51% in April’s fourth week

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations.

Tesla China’s new vehicle registrations saw a notable rise in the week of April 21-27, 2025. Over the week, the electric vehicle maker’s registrations saw an impressive 51% week-over-week rise, suggesting that domestic vehicle deliveries are on the rise once more.

Tesla China Results

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations. This represents a notable rise from the company’s registration numbers in the past weeks of April. For context, Tesla China saw 3,600 registrations in the week ending April 6, 5,400 registrations in the week ending April 13, and 6,780 registrations in the week ending April 20, 2025.

Considering that April is the first month of the second quarter, expectations were high that Tesla China was allocating Giga Shanghai’s output for vehicle exports. With 10,300 registrations in the week ending April 27, however, it would appear that the company’s domestic deliveries are picking up once more.

Tesla China does not report its weekly sales figures, though a general idea of the company’s overall perforce in the domestic auto sector can be inferred through new vehicle registrations. Fortunately, these registrations are closely tracked by industry watchers, as well as some local automakers like Li Auto.

Tesla Model 3 and Model Y in Focus

Tesla China produces the Model Y and Model 3 in Giga Shanghai. Both vehicles are also exported from China to foreign territories. As per industry watchers, it would appear that both the Model 3 and Model Y saw an increase in registrations in the week ending April 27.

The Model 3, for one, appears to have seen 3,200 registrations in the week ending April 27, a 14% increase from the 2,800 that were registered in the week ending April 20. For context, Tesla China saw just 1,500 new Model 3 registrations in the week ending April 13 and 1,040 registrations in the week ending April 6.

The Model Y, on the other hand, saw 7,100 registrations in the week ending April 27. That’s a 77.5% increase from the 4,000 that were registered in the week ending April 20. Tesla also saw 3,900 registrations in the week ending April 13, and 2,540 registrations in the week ending April 6, 2025.

News

Volkswagen teams with Uber for robotaxi service with the ID. Buzz

Volkswagen and Uber team up to launch a driverless ID. Buzz robotaxi fleet in U.S. cities. Testing starts in LA this year.

Volkswagen of America and Uber unveiled a plan to launch a commercial robotaxi service using autonomous electric ID. Buzz vehicles across U.S. cities over the next decade. The partnership marks a significant step for Volkswagen’s autonomous vehicle ambitions, leveraging Uber’s ride-hailing expertise.

The service will debut in Los Angeles by late 2026, with human safety operators initially overseeing the fleet before transitioning to fully driverless operations in 2027. Volkswagen ADMT, the German automaker’s autonomous subsidiary, will begin testing in Los Angeles later this year upon securing a testing permit from the California Department of Motor Vehicles. The California Public Utilities Commission will oversee permits for the commercial ride-hailing phase.

“Volkswagen is not just a car manufacturer — we are shaping the future of mobility, and our collaboration with Uber accelerates that vision,” said Christian Senger, CEO of Volkswagen Autonomous Mobility. “What really sets us apart is our ability to combine the best of both worlds–high-volume manufacturing expertise with cutting-edge technology and a deep understanding of urban mobility needs.”

The Trump administration’s recent policy shift, announced last Thursday by Transportation Secretary Sean Duffy, supports initiatives like VW and Uber’s partnerships by easing federal safety rules and crash reporting requirements on autonomous vehicle development. According to Duffy, the United States government wants to outpace Chinese competitors in autonomous vehicle development.

Volkswagen ADMT, which launched publicly in July 2023, has been testing 10 ID. Buzz vehicles equipped with Mobileye’s autonomous technology in Austin, reported TechCrunch. Two years ago, Volkswagen focused on selling self-driving vans and fleet management software rather than building its own ride-hailing service. VW’s strategy toward autonomous vehicles appears to have shifted, as reflected in its Uber partnership.

Uber will strengthen its autonomous vehicle portfolio through its partnership with Volkswagen. The ride-hailing service company has secured deals with over 14 firms, including Waymo in Austin and a forthcoming launch in Atlanta.

The Volkswagen-Uber collaboration positions both companies to capitalize on the growing robotaxi market. With testing imminent and regulatory support increasing, the ID. Buzz fleet could redefine urban mobility, blending Volkswagen’s manufacturing prowess with Uber’s ride-hailing network to compete in the evolving autonomous vehicle landscape.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News4 days ago

News4 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

News2 weeks ago

News2 weeks agoTesla’s top investor questions ahead of the Q1 2025 earnings call

-

News2 weeks ago

News2 weeks agoUnderrated Tesla safety feature recognized by China Automotive Research Institute

-

News2 weeks ago

News2 weeks agoTesla reveals its Q1 Supercharger voting winners, opens next round

-

News2 weeks ago

News2 weeks agoTesla police fleet saves nearly half a million in upkeep and repair costs

-

Investor's Corner7 days ago

Investor's Corner7 days agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call