News

Tesla Energy already exceeded FY 2023’s battery deployments–and there’s still one quarter left

Tesla Energy deployed 6.9 GWh of energy storage products in the third quarter of 2024. With these results, the company has already exceeded its full year 2023 energy deployments, with one whole quarter left in 2024.

While Tesla Energy’s 6.9 GWh worth of deployments in Q3 2024 are lower than Q2 2024’s 9.4 GWh, it remains extremely impressive. It is, if any, still the highest energy deployments in the third quarter by Tesla Energy to date.

$TSLA

Tesla Energy has been deployed over 20GWh this year! pic.twitter.com/UAWa5TTd1h— Tsla Chan (@Tslachan) October 2, 2024

Overall, Tesla Energy has deployed 20.3 GWh of battery storage products this 2024 so far. In comparison, the company deployed 14.7 GWh of energy products in full year 2023; 6.5 GWh of battery storage in full year 2022, and 3.99 GWh of energy storage products in full year 2021. This also means that Tesla’s battery storage deployments in Q3 2024 were higher than the company’s full year deployments in 2022.

Tesla’s energy deployments have accelerated with the ramp of the Lathrop Megafactory, which produces the company’s flagship energy product, the Megapack. The Megapack is designed for grid-scale use, as it offers 3.9 MWh of energy per unit. The Lathrop Megafactory has a capacity of 40 GWh per year, which is equivalent to about 10,000 Megapacks annually.

Tesla deployed 6.9 GWh of energy storage products in 24Q3. pic.twitter.com/EoflF1daKB— Roland Pircher (@piloly) October 2, 2024

Tesla Energy is expected to see a boost in Megapack production capacity next year, as the company is currently building its Shanghai Megafactory, which is also expected to have a capacity of 40 GWh per year. Considering how efficient Tesla’s Gigafactory Shanghai in China has become, however, there seems to be a good chance for the Shanghai Megafactory to produce more than 40 GWh worth of Megapacks annually.

The Shanghai Megafactory broke ground in late May 2024. Expectations are high that the facility could start initial Megapack production sometime in the first quarter of 2025.

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

Investor's Corner

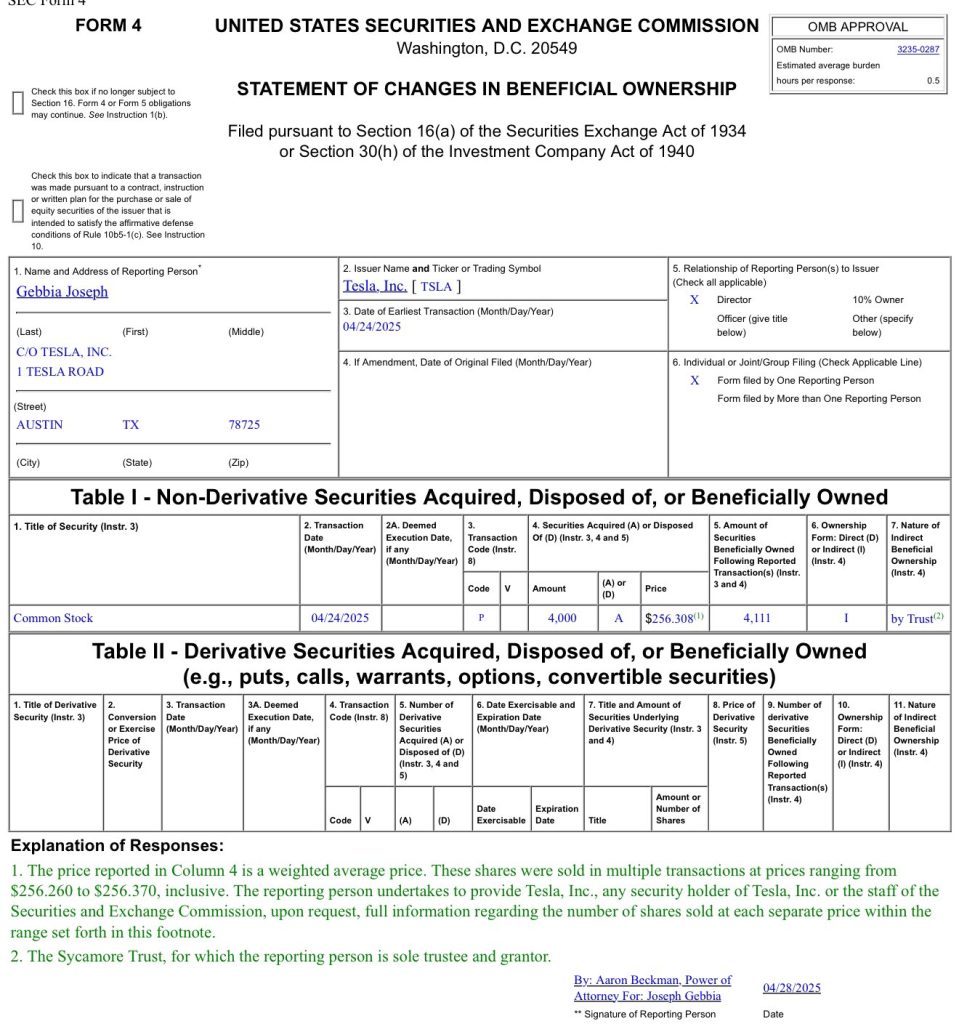

Tesla Board member and Airbnb co-founder loads up on TSLA ahead of robotaxi launch

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member’s purchase.

Tesla Board member and Airbnb Co-Founder Joe Gebbia has loaded up on TSLA stock (NASDAQ:TSLA). The Board member’s purchase comes just over a month before Tesla is expected to launch an initial robotaxi service in Austin, Texas.

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member in a post on social media.

The TSLA Purchase

As could be seen in a Form 4 submitted to the United States Securities and Exchange Commission (SEC) on Monday, Gebbia purchased about $1.02 million worth of TSLA stock. This was comprised of 4,000 TSLA shares at an average price of $256.308 per share.

Interestingly enough, Gebbia’s purchase represents the first time an insider has purchased TSLA stock in about five years. CEO Elon Musk, in response to a post on social media platform X about the Tesla Board member’s TSLA purchase, gave a nod of appreciation for Gebbia. “Joe rocks,” Musk wrote in his post on X.

Gebbia has served on Tesla’s Board as an independent director since 2022, and he is also a known friend of Elon Musk. He even joined the Trump Administration’s Department of Government Efficiency (DOGE) to help the government optimize its processes.

Just a Few Weeks Before Robotaxi

The timing of Gebbia’s TSLA stock purchase is quite interesting as the company is expected to launch a dedicated roboatxi service this June in Austin. A recent report from Insider, citing sources reportedly familiar with the matter, claimed that Tesla currently has 300 test operators driving robotaxis around Austin city streets. The publication’s sources also noted that Tesla has an internal deadline of June 1 for the robotaxi service’s rollout, but even a launch near the end of the month would be impressive.

During the Q1 2025 earnings call, Elon Musk explained that the robotaxi service that would be launched in June will feature autonomous rides in Model Y units. He also noted that the robotaxi service would see an expansion to other cities by the end of 2025. “The Teslas that will be fully autonomous in June in Austin are probably Model Ys. So, that is currently on track to be able to do paid rides fully autonomously in Austin in June and then to be in many other cities in the US by the end of this year,” Musk stated.

News

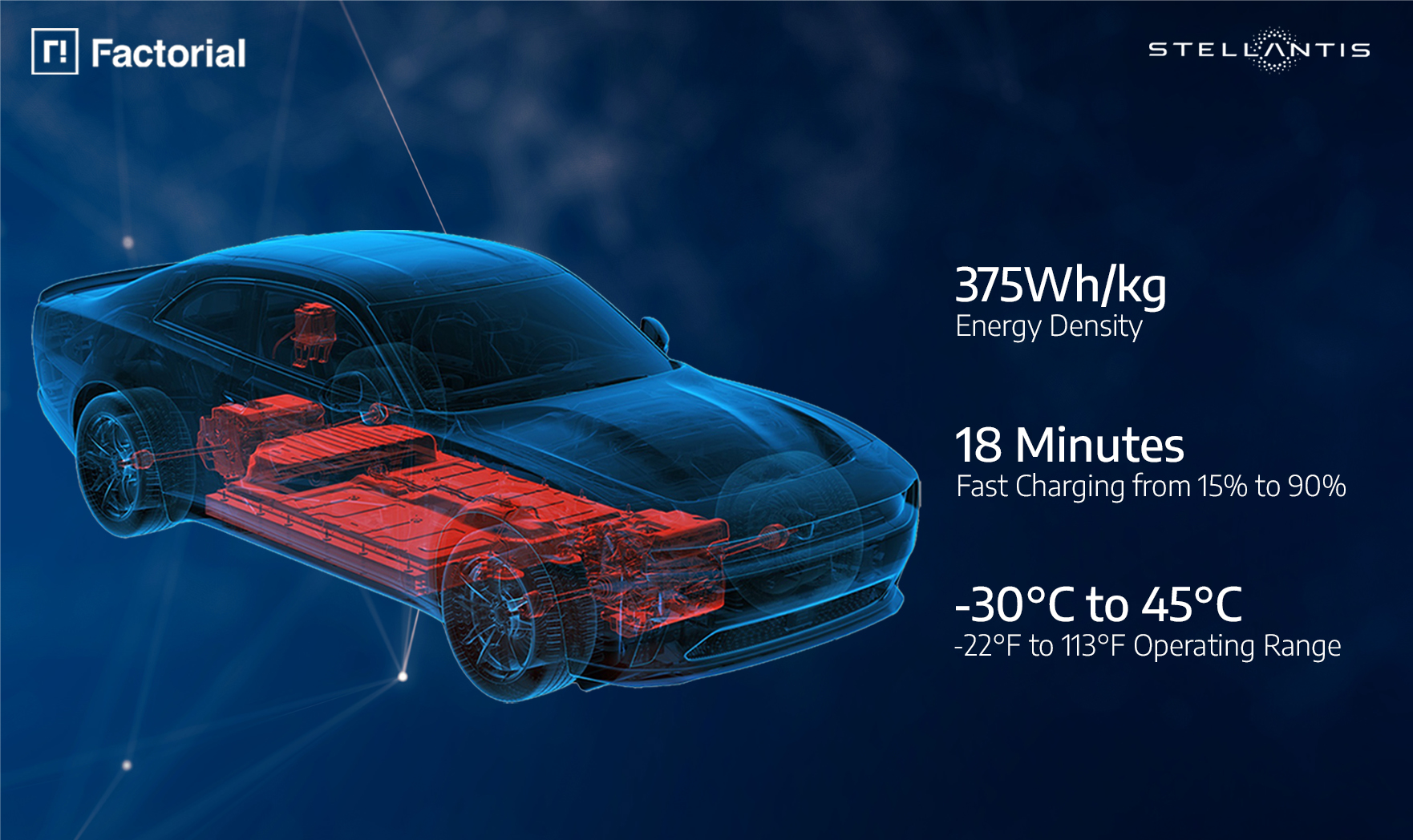

Stellantis unveils solid-state battery for EVs

Stellantis validated solid state battery cells for EVs: ultra-dense, fast-charging, and AI-optimized. Launching demo fleet by 2026.

Stellantis N.V. and Factorial Energy have validated Factorial’s automotive-sized FEST® solid-state battery cells, a major milestone for next-generation electric vehicle (EV) batteries. The breakthrough positions Stellantis and Factorial to advance EV performance with lighter, more efficient batteries.

“Reaching this level of performance reflects the strengths of our collaboration with Factorial.

“This breakthrough puts us at the forefront of the solid-state revolution, but we are not stopping there. We continue working together to push the boundaries and deliver even more advanced solutions, bringing us closer to lighter, more efficient batteries that reduce costs for our customers,” said Ned Curic, Stellanti’s Chief Engineering and Technology Officer.

The 77Ah FEST® cells achieved an energy density of 375Wh/kg, supporting over 600 cycles toward automotive qualification. Unlike lithium-ion batteries, these solid-state cells charge from 15% to over 90% in 18 minutes at room temperature and deliver high power with discharge rates up to 4C. Factorial’s AI-driven electrolyte formulation enables performance in temperatures from -30°C to 45°C (-22°F to 113°F), overcoming previous solid-state limitations.

“Battery development is about compromise. While optimizing one feature is simple, balancing high energy density, cycle life, fast charging, and safety in an automotive-sized battery with OEM validation is a breakthrough,” said Siyu Huang, CEO of Factorial Energy. “This achievement with Stellantis is bringing next-generation battery technology from research to reality.”

The collaboration optimizes battery pack design for reduced weight and improved efficiency, enhancing vehicle range and affordability. Stellantis invested $75 million in Factorial in 2021 and plans to integrate these batteries into a demonstration fleet by 2026. This fleet will validate the technology’s real-world performance, a critical step toward commercialization.

The milestone aligns with Stellantis’ push for sustainable EV solutions, leveraging Factorial’s disruptive technology to meet the rising demand for high-performance batteries. As the companies refine pack architecture, the validated cells promise faster charging and greater efficiency, potentially reshaping the EV market. With the demonstration fleet on the horizon, Stellantis and Factorial are poised to lead the solid-state battery push, delivering cost-effective, high-range EVs to consumers.

News

Tesla China vehicle registrations rise 51% in April’s fourth week

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations.

Tesla China’s new vehicle registrations saw a notable rise in the week of April 21-27, 2025. Over the week, the electric vehicle maker’s registrations saw an impressive 51% week-over-week rise, suggesting that domestic vehicle deliveries are on the rise once more.

Tesla China Results

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations. This represents a notable rise from the company’s registration numbers in the past weeks of April. For context, Tesla China saw 3,600 registrations in the week ending April 6, 5,400 registrations in the week ending April 13, and 6,780 registrations in the week ending April 20, 2025.

Considering that April is the first month of the second quarter, expectations were high that Tesla China was allocating Giga Shanghai’s output for vehicle exports. With 10,300 registrations in the week ending April 27, however, it would appear that the company’s domestic deliveries are picking up once more.

Tesla China does not report its weekly sales figures, though a general idea of the company’s overall perforce in the domestic auto sector can be inferred through new vehicle registrations. Fortunately, these registrations are closely tracked by industry watchers, as well as some local automakers like Li Auto.

Tesla Model 3 and Model Y in Focus

Tesla China produces the Model Y and Model 3 in Giga Shanghai. Both vehicles are also exported from China to foreign territories. As per industry watchers, it would appear that both the Model 3 and Model Y saw an increase in registrations in the week ending April 27.

The Model 3, for one, appears to have seen 3,200 registrations in the week ending April 27, a 14% increase from the 2,800 that were registered in the week ending April 20. For context, Tesla China saw just 1,500 new Model 3 registrations in the week ending April 13 and 1,040 registrations in the week ending April 6.

The Model Y, on the other hand, saw 7,100 registrations in the week ending April 27. That’s a 77.5% increase from the 4,000 that were registered in the week ending April 20. Tesla also saw 3,900 registrations in the week ending April 13, and 2,540 registrations in the week ending April 6, 2025.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News4 days ago

News4 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

News2 weeks ago

News2 weeks agoTesla’s top investor questions ahead of the Q1 2025 earnings call

-

News2 weeks ago

News2 weeks agoUnderrated Tesla safety feature recognized by China Automotive Research Institute

-

News2 weeks ago

News2 weeks agoTesla reveals its Q1 Supercharger voting winners, opens next round

-

News2 weeks ago

News2 weeks agoTesla police fleet saves nearly half a million in upkeep and repair costs

-

Investor's Corner7 days ago

Investor's Corner7 days agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call