News

Panasonic deepens ties with Tesla and bets big on Auto Tech

The following post was originally published on EVANNEX

As the inevitability of a major disruption in the auto industry becomes clearer, we’ve been reading (and writing) a lot about the companies that seem likely to lose out – Big Oil, incumbent automakers, some parts suppliers. But who will be the winners? Battery-makers obviously, but also providers of “auto tech.” This term includes the electronics that make electric powertrains go – motor controllers, inverters, chargers and the like – as well as self-driving hardware and software, and customer-facing components such as touchscreens, head-up displays and infotainment systems.

Tech companies are infiltrating the automotive space, making acquisitions and alliances to position themselves for profits under the new order. Last year, GM paid a billion bucks for Cruise Automation and invested half a billion in Lyft. Intel is putting its recent acquisition, Mobileye, to work in a partnership with BMW to build self-driving vehicles. Google is working with Fiat Chrysler on self-driving cars and providing display systems for Volvo. Israeli startup Otonomo is competing with Google and Apple to sell user data to Daimler and other automakers.

No company is better placed to thrive in the electric, automated future than Panasonic, which is steadily redirecting its focus from consumer electronics to auto tech. In February, Panasonic named Tom Gebhardt Chairman and CEO of its North American operations. Gebhardt’s former post was leading the company’s Automotive Systems subsidiary.

“Our business has evolved… from purely a consumer business to a B2B business,” Gebhardt recently told Business Insider. “There’s a number of reasons for that: The commoditization of consumer products [and] the unfavorability in some of the cost models led us to look for better values in in-vehicle technologies.”

Gebhardt said Panasonic is devoting more resources to digital cockpits and vehicle entertainment systems as self-driving vehicles get closer to reality. “If the scenario says the car drives itself, it’s similar to sitting in an airplane seat, because you’re no longer actively driving,” he said. “We see that as an evolution of the space that has infinite possibilities for us.”

Panasonic offered several glimpses of those possibilities at CES in January. Fiat Chrysler’s semi-autonomous Portal concept car featured a Panasonic touchscreen with facial and voice recognition. Panasonic also revealed a new system with a head-up display and augmented reality that’s designed to replace the traditional instrument cluster and many of the car’s physical controls. Some speculated that it was a preview of Model 3’s user interface. A few days later, Panasonic CEO Kazuhiro Tsuga said in an interview, “We are deeply interested in Tesla’s self-driving system. We are hoping to expand our collaboration by jointly developing devices for that, such as sensors.”

Meanwhile, Panasonic’s collaboration with Tesla on batteries gives it a large stake in the potential profits as electrification gathers momentum. Panasonic is one of the largest battery manufacturers in the world, and it plans to invest $1.6 billion in Tesla’s Gigafactory. And looking back, in 2007 Panasonic began working with Tesla on the Roadster and has established a strong track record supporting Tesla over the past decade — even investing $30 million with Tesla at a critical juncture (in 2010) in order to develop lithium-ion battery cells for its forthcoming Model S sedan.

A lot has changed since those early days. Nevertheless, global electric vehicle sales are still hovering around 1% of the market. That said, there are many reasons to expect a breakout soon. Orders for Tesla’s upcoming Model 3 keep growing, and legacy automakers from VW to BMW to Ford are responding with plans for new electric models.

“The future is definitely electric, no question in my mind,” Gebhardt said. “What is the future timeline? Is it 10 years, 15 years, 40 years? It’s just a matter of what the adoption hits at the scale that makes this a slam dunk… We’re pretty bullish on the fact that this is a space that will continue to grow and there’s value there.”

Gebhardt conceded that EV adoption is slow in the US, a trend that may continue now that the federal government has shifted from supporting electrification to trying to revive the elderly fossil fuel industries. However, he characterizes this as “a short-term problem,” and points out that it’s a very different scene in China, the world’s largest car market. “If they adopt in a big way, that changes the balance of where electric is today versus where it will be going.”

Panasonic’s increasing investment in auto tech is already paying off, according to Nikkei Asian Review. At a recent financial briefing, President Kazuhiro Tsuga said the company is expecting an increase in net profit in fiscal year 2017, its first gain in two years, largely because of strong growth in EV batteries and other auto tech-related products. “We are confident we can achieve increases both in sales and profit for the year through March 2018 and later years,” he said.

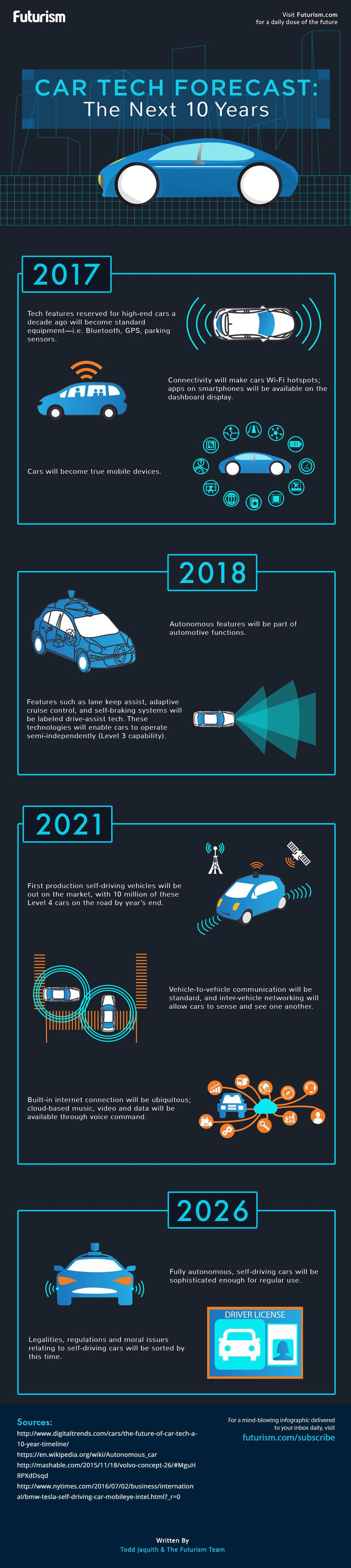

Infographic

What auto tech opportunities are coming in the next decade? Check out this infographic for a few possibilities…

Sources: Business Insider, Nikkei Asian Review / Infographic: Futurism

Investor's Corner

Tesla Board member and Airbnb co-founder loads up on TSLA ahead of robotaxi launch

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member’s purchase.

Tesla Board member and Airbnb Co-Founder Joe Gebbia has loaded up on TSLA stock (NASDAQ:TSLA). The Board member’s purchase comes just over a month before Tesla is expected to launch an initial robotaxi service in Austin, Texas.

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member in a post on social media.

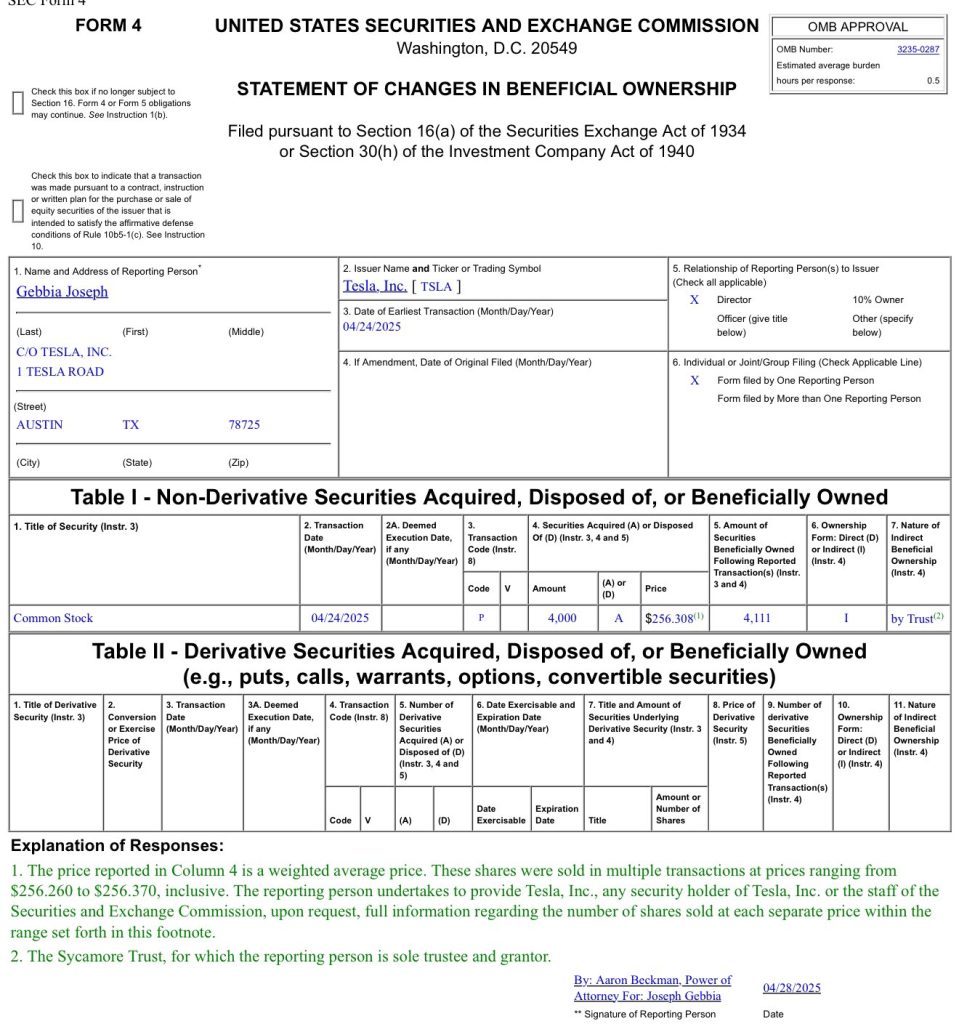

The TSLA Purchase

As could be seen in a Form 4 submitted to the United States Securities and Exchange Commission (SEC) on Monday, Gebbia purchased about $1.02 million worth of TSLA stock. This was comprised of 4,000 TSLA shares at an average price of $256.308 per share.

Interestingly enough, Gebbia’s purchase represents the first time an insider has purchased TSLA stock in about five years. CEO Elon Musk, in response to a post on social media platform X about the Tesla Board member’s TSLA purchase, gave a nod of appreciation for Gebbia. “Joe rocks,” Musk wrote in his post on X.

Gebbia has served on Tesla’s Board as an independent director since 2022, and he is also a known friend of Elon Musk. He even joined the Trump Administration’s Department of Government Efficiency (DOGE) to help the government optimize its processes.

Just a Few Weeks Before Robotaxi

The timing of Gebbia’s TSLA stock purchase is quite interesting as the company is expected to launch a dedicated roboatxi service this June in Austin. A recent report from Insider, citing sources reportedly familiar with the matter, claimed that Tesla currently has 300 test operators driving robotaxis around Austin city streets. The publication’s sources also noted that Tesla has an internal deadline of June 1 for the robotaxi service’s rollout, but even a launch near the end of the month would be impressive.

During the Q1 2025 earnings call, Elon Musk explained that the robotaxi service that would be launched in June will feature autonomous rides in Model Y units. He also noted that the robotaxi service would see an expansion to other cities by the end of 2025. “The Teslas that will be fully autonomous in June in Austin are probably Model Ys. So, that is currently on track to be able to do paid rides fully autonomously in Austin in June and then to be in many other cities in the US by the end of this year,” Musk stated.

News

Stellantis unveils solid-state battery for EVs

Stellantis validated solid state battery cells for EVs: ultra-dense, fast-charging, and AI-optimized. Launching demo fleet by 2026.

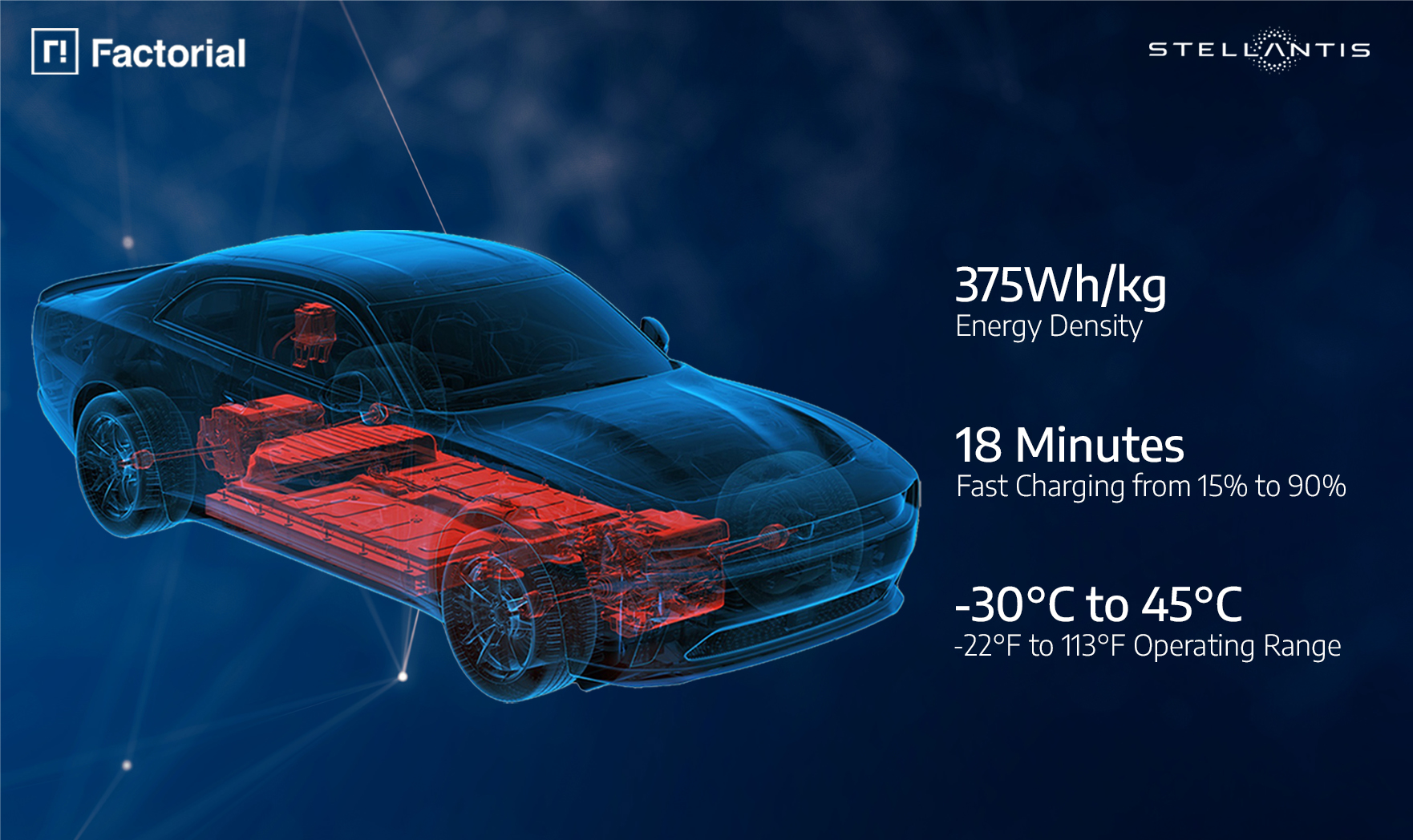

Stellantis N.V. and Factorial Energy have validated Factorial’s automotive-sized FEST® solid-state battery cells, a major milestone for next-generation electric vehicle (EV) batteries. The breakthrough positions Stellantis and Factorial to advance EV performance with lighter, more efficient batteries.

“Reaching this level of performance reflects the strengths of our collaboration with Factorial.

“This breakthrough puts us at the forefront of the solid-state revolution, but we are not stopping there. We continue working together to push the boundaries and deliver even more advanced solutions, bringing us closer to lighter, more efficient batteries that reduce costs for our customers,” said Ned Curic, Stellanti’s Chief Engineering and Technology Officer.

The 77Ah FEST® cells achieved an energy density of 375Wh/kg, supporting over 600 cycles toward automotive qualification. Unlike lithium-ion batteries, these solid-state cells charge from 15% to over 90% in 18 minutes at room temperature and deliver high power with discharge rates up to 4C. Factorial’s AI-driven electrolyte formulation enables performance in temperatures from -30°C to 45°C (-22°F to 113°F), overcoming previous solid-state limitations.

“Battery development is about compromise. While optimizing one feature is simple, balancing high energy density, cycle life, fast charging, and safety in an automotive-sized battery with OEM validation is a breakthrough,” said Siyu Huang, CEO of Factorial Energy. “This achievement with Stellantis is bringing next-generation battery technology from research to reality.”

The collaboration optimizes battery pack design for reduced weight and improved efficiency, enhancing vehicle range and affordability. Stellantis invested $75 million in Factorial in 2021 and plans to integrate these batteries into a demonstration fleet by 2026. This fleet will validate the technology’s real-world performance, a critical step toward commercialization.

The milestone aligns with Stellantis’ push for sustainable EV solutions, leveraging Factorial’s disruptive technology to meet the rising demand for high-performance batteries. As the companies refine pack architecture, the validated cells promise faster charging and greater efficiency, potentially reshaping the EV market. With the demonstration fleet on the horizon, Stellantis and Factorial are poised to lead the solid-state battery push, delivering cost-effective, high-range EVs to consumers.

News

Tesla China vehicle registrations rise 51% in April’s fourth week

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations.

Tesla China’s new vehicle registrations saw a notable rise in the week of April 21-27, 2025. Over the week, the electric vehicle maker’s registrations saw an impressive 51% week-over-week rise, suggesting that domestic vehicle deliveries are on the rise once more.

Tesla China Results

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations. This represents a notable rise from the company’s registration numbers in the past weeks of April. For context, Tesla China saw 3,600 registrations in the week ending April 6, 5,400 registrations in the week ending April 13, and 6,780 registrations in the week ending April 20, 2025.

Considering that April is the first month of the second quarter, expectations were high that Tesla China was allocating Giga Shanghai’s output for vehicle exports. With 10,300 registrations in the week ending April 27, however, it would appear that the company’s domestic deliveries are picking up once more.

Tesla China does not report its weekly sales figures, though a general idea of the company’s overall perforce in the domestic auto sector can be inferred through new vehicle registrations. Fortunately, these registrations are closely tracked by industry watchers, as well as some local automakers like Li Auto.

Tesla Model 3 and Model Y in Focus

Tesla China produces the Model Y and Model 3 in Giga Shanghai. Both vehicles are also exported from China to foreign territories. As per industry watchers, it would appear that both the Model 3 and Model Y saw an increase in registrations in the week ending April 27.

The Model 3, for one, appears to have seen 3,200 registrations in the week ending April 27, a 14% increase from the 2,800 that were registered in the week ending April 20. For context, Tesla China saw just 1,500 new Model 3 registrations in the week ending April 13 and 1,040 registrations in the week ending April 6.

The Model Y, on the other hand, saw 7,100 registrations in the week ending April 27. That’s a 77.5% increase from the 4,000 that were registered in the week ending April 20. Tesla also saw 3,900 registrations in the week ending April 13, and 2,540 registrations in the week ending April 6, 2025.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News4 days ago

News4 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

News2 weeks ago

News2 weeks agoTesla’s top investor questions ahead of the Q1 2025 earnings call

-

News2 weeks ago

News2 weeks agoUnderrated Tesla safety feature recognized by China Automotive Research Institute

-

News2 weeks ago

News2 weeks agoTesla reveals its Q1 Supercharger voting winners, opens next round

-

News2 weeks ago

News2 weeks agoTesla police fleet saves nearly half a million in upkeep and repair costs

-

Investor's Corner7 days ago

Investor's Corner7 days agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call