Transitioning to renewable energy requires a multi-faceted approach, and power storage from sources such as solar and wind energy will play an increasingly important role in that playbook in the future. To tackle this problem, former Northvolt and Tesla workers have joined forces to focus on the scalability of battery production with the new company Peak Energy.

Peak Energy aims to mass-produce giant battery storage systems for renewable sources such as wind and solar (via CNBC). CEO and Founder Landon Mossburg formerly worked at Tesla and went on to work as an executive at Northvolt before founding Peak Energy earlier this year.

The company plans to scale a more affordable battery chemistry than the lithium-ion batteries used in Tesla’s Megapacks, instead hoping to produce large-scale battery systems with lower-density, lower-cost sodium-ion technology.

Since the company plans to mass-scale an existing product, Peak Energy President and COO Cameron Dales notes that they don’t consider the company a startup, although it only started in June. Interestingly, Peak Energy is looking to partner with a technology company specializing in battery tech, but specifically one that doesn’t yet have the ability to scale its products.

“A normal Silicon Valley startup is 10 years in the lab, come up with a better mousetrap and go to market. We’re completely the opposite,” Dales told CNBC in an interview.

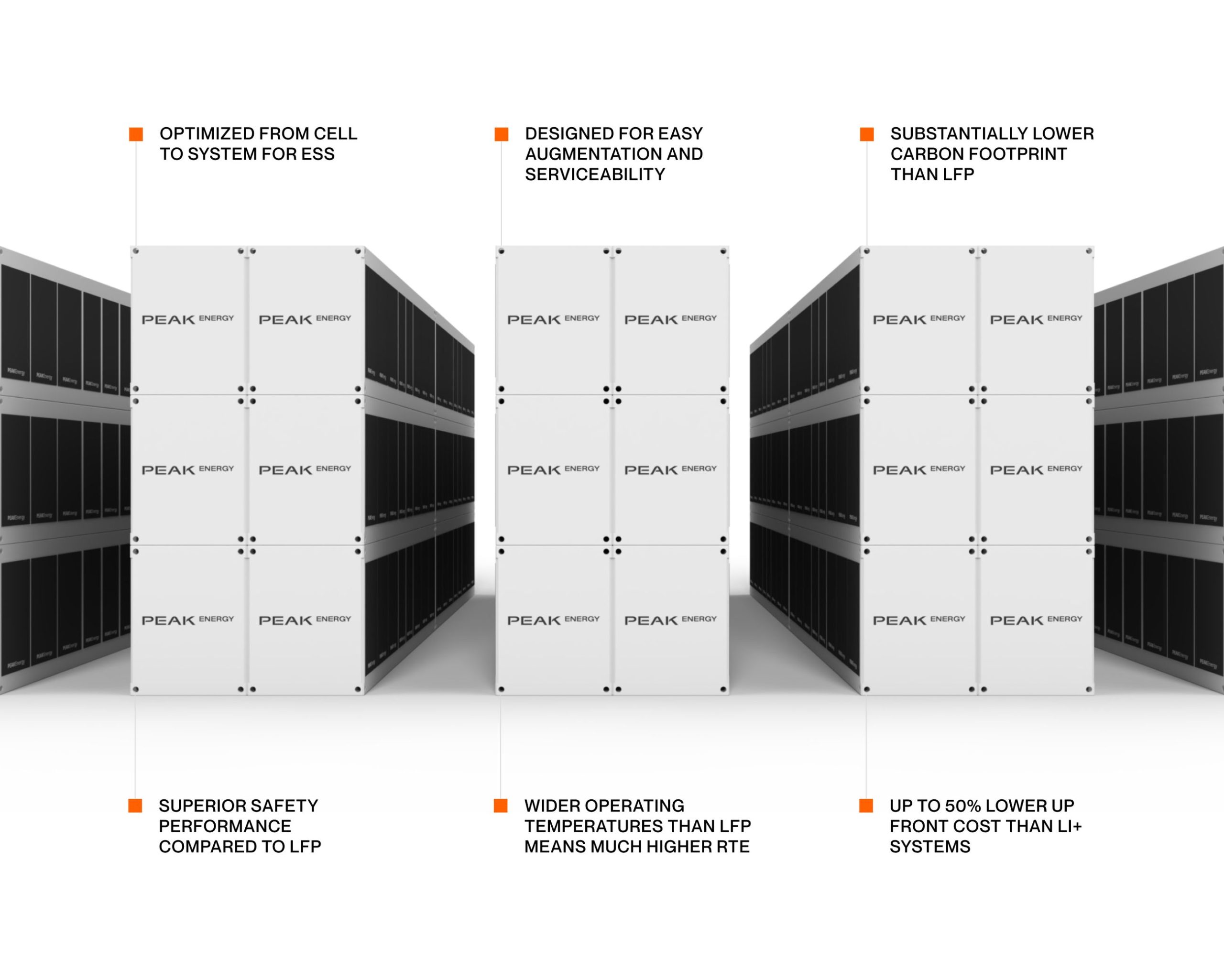

The company plans to make individual sodium-ion battery cells, roughly the size of a loaf of bread, according to Dales. These cells will then be used together to make larger modules about the size of a filing cabinet. These filing cabinet modules could be deployed at solar or wind farms at volumes of 50-100 per order.

Credit: Peak Energy

With 100 blocks, Mossburg explains, the battery system is expected to be able to power as many as 62,500 homes for up to four hours.

He also thinks that the company’s battery systems could cost around half the cost of a Tesla Megapack’s $1.3 million before installation, though it’s still too early for the company to have a price on its products.

“In the battery market it turns out the rarest commodity is not the technology — there are many excellent ideas out there at academic labs and startups — but rather the ability to scale to manufacturing,” Mossburg said. “The difficulty of manufacturing scale up is one of the reasons you see so many ‘breakthrough battery technology’ announcements but very very few companies who actually reach market.”

The company has also announced a $10 million funding round led by Eclipse Ventures’ Greg Reichow, a former Tesla executive who was in charge of battery, motor and electronics manufacturing before going on to lead global manufacturing. Crucially, Dales points out to CNBC that Reichow also led the development of Tesla’s Giga Nevada battery factory with partner Panasonic, which he considers the first mass-scale battery factory in the world.

TDK Ventures, owned by Japanese multinational electronics manufacturer TDK, will also join the funding round.

“The number one issue we face as it relates to expanding renewable energy sources is storage,” Reichow said. “This problem must be solved, but the existing approaches using lithium-ion and other technologies are not yet at a price point that enables the kind of scaling that society needs across sectors.”

The U.S. Energy Information Administration forecasts battery storage capacity to increase from just 9 gigawatts last year to as much as 49 GW by 2030 before jumping to 247 GW in 2050. This projection shows demand for mass-scale battery storage will continue to grow, especially as transportation and other sectors shift toward renewable energy sources.

Peak Energy currently hopes to produce “double digit gigawatt” amounts of battery cells by 2030, set to be used for its own battery systems and other applications. According to Mossburg, building a battery factory will take between $50 million and $100 million per GW. He also says a 30 GW factory would have between 2,000 and 3,000 workers, requiring a 1-2 million square-foot space.

Mossburg has experience scaling battery production at Northvolt, founded by former Tesla Global Head of Sourcing and Supply Chain Peter Carlsson, who worked for the automaker from 2011-2015. By the time Mossburg left Northvolt, the company had grown to employ 4,000 people from just 300 only 18 months prior.

″We’re running a playbook which I and the rest of the executive team initially demonstrated and deployed at Northvolt,” Mossburg said.

Tesla Megapack powers new 196 MWh battery storage system in Europe

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send your tips to us at tips@teslarati.com.

Investor's Corner

Tesla Board member and Airbnb co-founder loads up on TSLA ahead of robotaxi launch

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member’s purchase.

Tesla Board member and Airbnb Co-Founder Joe Gebbia has loaded up on TSLA stock (NASDAQ:TSLA). The Board member’s purchase comes just over a month before Tesla is expected to launch an initial robotaxi service in Austin, Texas.

Tesla CEO Elon Musk gave a nod of appreciation for the Tesla Board member in a post on social media.

The TSLA Purchase

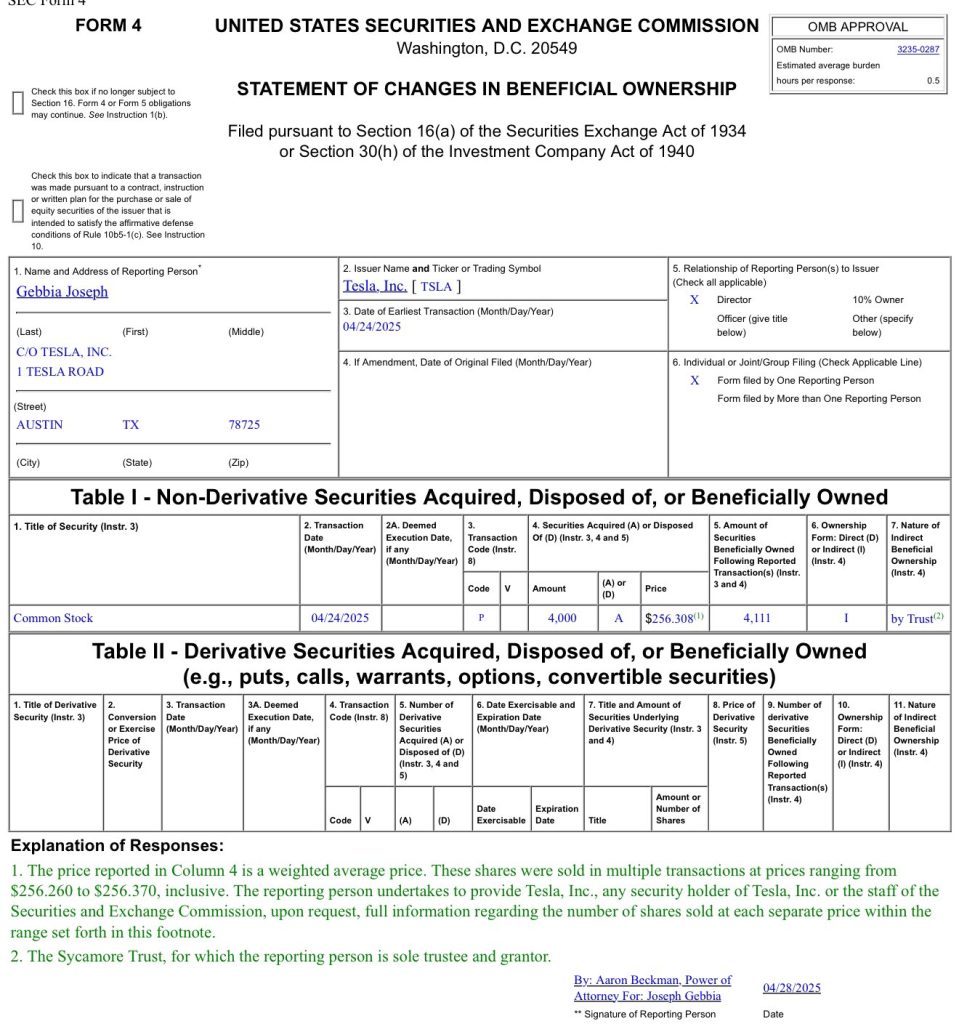

As could be seen in a Form 4 submitted to the United States Securities and Exchange Commission (SEC) on Monday, Gebbia purchased about $1.02 million worth of TSLA stock. This was comprised of 4,000 TSLA shares at an average price of $256.308 per share.

Interestingly enough, Gebbia’s purchase represents the first time an insider has purchased TSLA stock in about five years. CEO Elon Musk, in response to a post on social media platform X about the Tesla Board member’s TSLA purchase, gave a nod of appreciation for Gebbia. “Joe rocks,” Musk wrote in his post on X.

Gebbia has served on Tesla’s Board as an independent director since 2022, and he is also a known friend of Elon Musk. He even joined the Trump Administration’s Department of Government Efficiency (DOGE) to help the government optimize its processes.

Just a Few Weeks Before Robotaxi

The timing of Gebbia’s TSLA stock purchase is quite interesting as the company is expected to launch a dedicated roboatxi service this June in Austin. A recent report from Insider, citing sources reportedly familiar with the matter, claimed that Tesla currently has 300 test operators driving robotaxis around Austin city streets. The publication’s sources also noted that Tesla has an internal deadline of June 1 for the robotaxi service’s rollout, but even a launch near the end of the month would be impressive.

During the Q1 2025 earnings call, Elon Musk explained that the robotaxi service that would be launched in June will feature autonomous rides in Model Y units. He also noted that the robotaxi service would see an expansion to other cities by the end of 2025. “The Teslas that will be fully autonomous in June in Austin are probably Model Ys. So, that is currently on track to be able to do paid rides fully autonomously in Austin in June and then to be in many other cities in the US by the end of this year,” Musk stated.

News

Stellantis unveils solid-state battery for EVs

Stellantis validated solid state battery cells for EVs: ultra-dense, fast-charging, and AI-optimized. Launching demo fleet by 2026.

Stellantis N.V. and Factorial Energy have validated Factorial’s automotive-sized FEST® solid-state battery cells, a major milestone for next-generation electric vehicle (EV) batteries. The breakthrough positions Stellantis and Factorial to advance EV performance with lighter, more efficient batteries.

“Reaching this level of performance reflects the strengths of our collaboration with Factorial.

“This breakthrough puts us at the forefront of the solid-state revolution, but we are not stopping there. We continue working together to push the boundaries and deliver even more advanced solutions, bringing us closer to lighter, more efficient batteries that reduce costs for our customers,” said Ned Curic, Stellanti’s Chief Engineering and Technology Officer.

The 77Ah FEST® cells achieved an energy density of 375Wh/kg, supporting over 600 cycles toward automotive qualification. Unlike lithium-ion batteries, these solid-state cells charge from 15% to over 90% in 18 minutes at room temperature and deliver high power with discharge rates up to 4C. Factorial’s AI-driven electrolyte formulation enables performance in temperatures from -30°C to 45°C (-22°F to 113°F), overcoming previous solid-state limitations.

“Battery development is about compromise. While optimizing one feature is simple, balancing high energy density, cycle life, fast charging, and safety in an automotive-sized battery with OEM validation is a breakthrough,” said Siyu Huang, CEO of Factorial Energy. “This achievement with Stellantis is bringing next-generation battery technology from research to reality.”

The collaboration optimizes battery pack design for reduced weight and improved efficiency, enhancing vehicle range and affordability. Stellantis invested $75 million in Factorial in 2021 and plans to integrate these batteries into a demonstration fleet by 2026. This fleet will validate the technology’s real-world performance, a critical step toward commercialization.

The milestone aligns with Stellantis’ push for sustainable EV solutions, leveraging Factorial’s disruptive technology to meet the rising demand for high-performance batteries. As the companies refine pack architecture, the validated cells promise faster charging and greater efficiency, potentially reshaping the EV market. With the demonstration fleet on the horizon, Stellantis and Factorial are poised to lead the solid-state battery push, delivering cost-effective, high-range EVs to consumers.

News

Tesla China vehicle registrations rise 51% in April’s fourth week

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations.

Tesla China’s new vehicle registrations saw a notable rise in the week of April 21-27, 2025. Over the week, the electric vehicle maker’s registrations saw an impressive 51% week-over-week rise, suggesting that domestic vehicle deliveries are on the rise once more.

Tesla China Results

In the week ending April 27, Tesla China saw 10,300 new vehicle registrations. This represents a notable rise from the company’s registration numbers in the past weeks of April. For context, Tesla China saw 3,600 registrations in the week ending April 6, 5,400 registrations in the week ending April 13, and 6,780 registrations in the week ending April 20, 2025.

Considering that April is the first month of the second quarter, expectations were high that Tesla China was allocating Giga Shanghai’s output for vehicle exports. With 10,300 registrations in the week ending April 27, however, it would appear that the company’s domestic deliveries are picking up once more.

Tesla China does not report its weekly sales figures, though a general idea of the company’s overall perforce in the domestic auto sector can be inferred through new vehicle registrations. Fortunately, these registrations are closely tracked by industry watchers, as well as some local automakers like Li Auto.

Tesla Model 3 and Model Y in Focus

Tesla China produces the Model Y and Model 3 in Giga Shanghai. Both vehicles are also exported from China to foreign territories. As per industry watchers, it would appear that both the Model 3 and Model Y saw an increase in registrations in the week ending April 27.

The Model 3, for one, appears to have seen 3,200 registrations in the week ending April 27, a 14% increase from the 2,800 that were registered in the week ending April 20. For context, Tesla China saw just 1,500 new Model 3 registrations in the week ending April 13 and 1,040 registrations in the week ending April 6.

The Model Y, on the other hand, saw 7,100 registrations in the week ending April 27. That’s a 77.5% increase from the 4,000 that were registered in the week ending April 20. Tesla also saw 3,900 registrations in the week ending April 13, and 2,540 registrations in the week ending April 6, 2025.

-

News1 week ago

News1 week agoTesla’s Hollywood Diner is finally getting close to opening

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News4 days ago

News4 days agoTesla is trying to make a statement with its Q2 delivery numbers

-

News2 weeks ago

News2 weeks agoTesla’s top investor questions ahead of the Q1 2025 earnings call

-

News2 weeks ago

News2 weeks agoUnderrated Tesla safety feature recognized by China Automotive Research Institute

-

News2 weeks ago

News2 weeks agoTesla reveals its Q1 Supercharger voting winners, opens next round

-

News2 weeks ago

News2 weeks agoTesla police fleet saves nearly half a million in upkeep and repair costs

-

Investor's Corner7 days ago

Investor's Corner7 days agoLIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call